NEW DELHI: India’s internet story is losing some of its lustre, with implications for internet commerce companies.

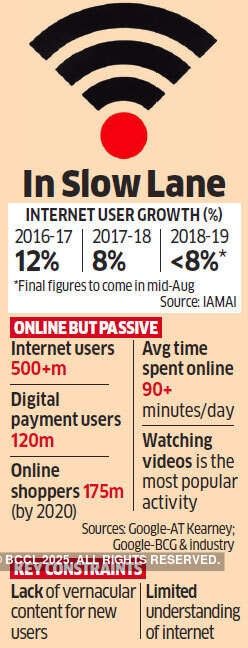

NEW DELHI: India’s internet story is losing some of its lustre, with implications for internet commerce companies.Growth in internet user base is slated to come down for the second consecutive financial year — 2018-19 growth rate will be even less than the 8% witnessed in 2017-18, which was a sharp drop from 2016-17’s 12%.

The final figure will be released by the Internet and Mobile Association of India (IAMAI) in mid-August. ET spoke to people familiar with the ongoing exercise. “I suspect new internet user growth will decelerate even further and will reach a plateau in the next four to five years,” said Subho Ray, president, IAMAI.

Moreover, the proportion of internet users engaging in digital commerce is also not moving upwards. For example, only around 120 million people are using digital payments out of a user base of around 500 million internet users, as per IAMAI.

By 2020, according to a Google-AT Kearney report, only 175 million Indians are expected to engage in online shopping. IAMAI’s Ray, however, puts the number of active online shoppers at just around 50 million.

More than half of India’s population is not online and growth in new users and digital commerce should be brisk. But experts say slowing growth in user base is happening on account of a number of factors.

First, for many millions going online is still an expensive proposition.

‘Need to Educate Users’

And feature phones to smartphone conversion in these segments is very low.

Second, most new users are vernacular language proficient and they find English language-dominated internet both complex and lacking in vernacular content. Datafrom Nielsen shows average time spent online in India is more than 90 minutes a day. And watching videos is the most popular activity.

A Google India spokesperson said, “Every new user coming online is an Indian language user and has very limited understanding of what internet can do for them…we also need products that serve the needs of these users.”

Anand Kumar Bajaj, CEO, PayNearby said, “What we are seeing is wasteful consumption. People wasting their time watching videos. There’s a need to educate users on what they can do with mobile internet.”

He also argued that even among transacting users, the magnet is cashbacks. Once cashbacks go, at least some users are likely to go back to free videos.

Others also see data usage coming down. Chris Lane, managing director, Asia-Pacific Telecommunications at research firm Bernstein told ET recently, “As India already has one of the highest data consumption rates (for 4G users), the pace of growth going forward is likely to slow.”

No comments:

Post a Comment