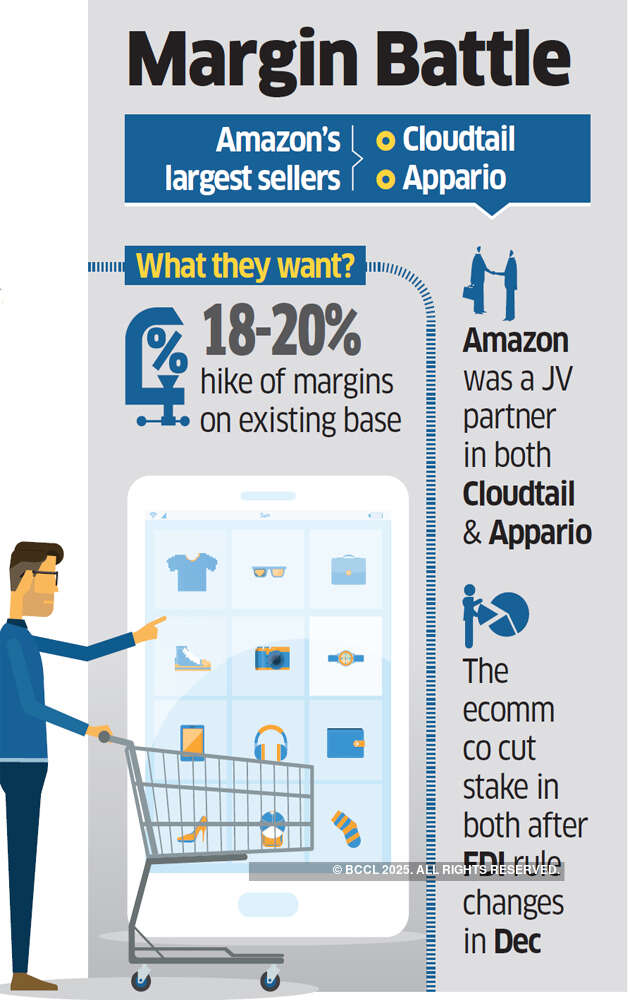

Cloudtail and Appario, the two largest sellers on Amazon.in, are renegotiating deals and asking for higher margins from brands and distributors as they chase profitability post equity dilution by Amazon, multiple people familiar with the development said.

Cloudtail and Appario, the two largest sellers on Amazon.in, are renegotiating deals and asking for higher margins from brands and distributors as they chase profitability post equity dilution by Amazon, multiple people familiar with the development said.“They are asking for 18-20% hike of margins on the existing margin base,” said a top executive of a large FMCG seller on Cloudtail, owned by Infosys cofounder NR Narayana Murthy. “For example, earlier they were charging 10% margin for a particular product, now (they are) asking for 12% margin.”

The move comes barely months after Amazon, which was a joint venture partner in both Cloudtail and Patni Group-owned Appario, significantly reduced its stake in both the firms to small minority shares following a change in foreign direct investment(FDI) rules for ecommerce marketplaces in December.

Two senior executive of consumer electronics brands that sell through Cloudtail and Appario said the demand for higher margin had started 2-3 months ago, after the Indian partners increased their shareholdings in their separate JVs with Amazon. Other FMCG and fashion brands said the renegotiations have gathered pace in recent weeks.

Cloudtail and Appario did not respond to emails seeking comments as of press time Monday.

In December, the government had amended FDI policy for ecommerce marketplaces in a bid to plug loopholes that both Amazon and rival Walmart-owned Flipkart were widely alleged to have misused. Both were accused by many of virtually running “inventory-led” marketplaces — that India forbids — by selling products through Cloudtail and Appario in Amazon’s case and RetailNet and other preferred sellers on Flipkart. The December policy change also barred marketplace operators from selling products from any of its “group companies”.

In February, when the new legislations kicked in, Murthy’s Catamaran Ventures hiked its stake in Cloudtail’s parent company Prione Business Services to 76% from 51%, reducing Amazon Asia’s stake to 24% from 49%. Similar changes were made in Appario as well.

With the changes, Cloudtail and Appario ceased to be an Amazon group companies, thus becoming eligible to sell on the marketplace. “The entire focus of Cloudtail and Appario is now on profitability and viability as compared to revenue and building market share (that was the focus prior to the change in FDI rules),” said one of the executives cited earlier.

The FMCG seller quoted earlier said, “Earlier there was no issue with working capital as there was free flow of money from Amazon. Now, Narayana Murthy is not running a charity here.”

The latest renegotiation of margins by Cloudtail and Appario is also factoring in logistic cost and marketplace commissions to Amazon.in, considering the USbased etailer has decided to not offer any priority treatment to any seller such as concession in logistic charges and commission, the executives said.

The two firms are now demanding 20-21% margin on audio products, up from 17% earlier, while in television, they are asking for 10-11% margin against 9% earlier, they said. However, for some brands in smartphones the sellers are ready to sell even at no margin.

this is awesom, but i am looking for appario retail private ltd contact details sir, please help me with that. Thanks

ReplyDelete