BENGALURU: Udaan, an online marketplace that supplies products and gives loans to small merchants, is in talks to raise a new round of funding of around $500 million.

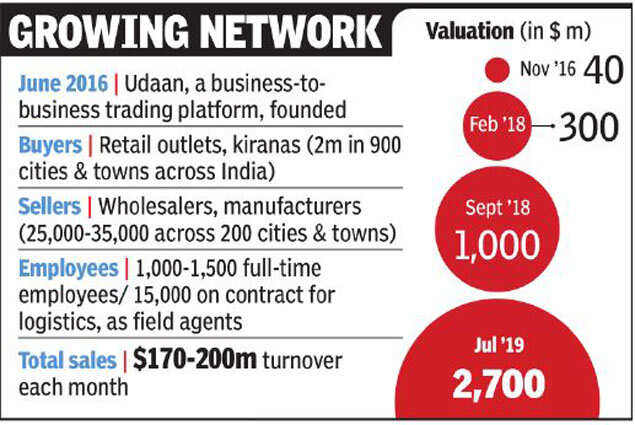

BENGALURU: Udaan, an online marketplace that supplies products and gives loans to small merchants, is in talks to raise a new round of funding of around $500 million. This will be at a post-money valuation of close to $2.7 billion, as business-to-business (B2B) startups continue to be high on investors’ radar. The three-year-old entity had become the fastest startup in the country to reach unicorn status last year.

Udaan is in talks with existing backers DST Global and Lightspeed Venture Partners — besides new investors, including hedge funds like US-based Altimeter Capital and China’s Hillhouse Capital — to invest in the latest round, said two sources briefed on the matter. “The capital is being raised to build out the supply chain network for the company besides scaling up the NBFC business,” said one of the sources.

Udaan is looking to scale up its expansion in the market where players like US retail giants Walmart and Amazon, Chinese e-commerce major Alibaba and homegrown giant Reliance Industries are also expected to make an aggressive push.

The funding round is expected to be finalised in the coming months. Since inception, Udaan has raised three rounds, taking total capital raised to $285 million. While Lightspeed and DST Global are existing backers, Altimeter Capital has backed companies like Practo and Pine Labs in India, while Hillhouse has backed Swiggy, CarDekho and Paper Boat.

Emailed queries sent to Lightspeed, DST Global, Hillhouse and Altimeter did not elicit a response till the time of going to press. Udaan co-founder Sujeet Kumar declined to comment.

The company has been doing annualised gross sales of over $2 billion across categories — from fruits & vegetables, smartphones, fast moving consumer goods (FMCG), fashion & apparel, staples to electronics — said the sources. Udaan is also investing heavily to build out its network, losing over $10 million a month.

The startup was founded in June 2016 by three former top Flipkart executives — Vaibhav Gupta, Amod Malviya and Sujeet Kumar. While Gupta was SVP of business finance and analytics at Flipkart, Malviya was chief technology officer. Kumar was one of the earliest employees responsible for building logistics unit Ekart and was also looking after WS Retail, the main seller on Flipkart.

Udaan started out by building a marketplace for merchants to buy and sell goods from distributors and manufacturers. It has a network of 2 million retailers or kiranas across 900 cities and towns in the country and has over 25,000 sellers on the platform, including small manufacturers, wholesalers and companies like Reckitt Benckiser, Marico and Motorola. Besides offering supply chain solutions, it has also started disbursing loans in the range of Rs 10,000 to Rs 2 lakh to about 1 lakh buyers on the platform after setting up an NBFC last year.

Overall, the B2B commerce space has been attracting money in the last few months as Tiger Global Management led a $90-million round in vegetables supply chain player NinjaCart. Tiger Global, along with Sequoia, also backed industrial goods marketplace Moglix with a $60-million round.

The interest in the space is being driven by investors’ belief that companies can build more profitable models. Last month, one of the country’s oldest B2B classifieds and commerce platform IndiaMart also went public in a Rs 475-crore IPO with share prices shooting up 50% on its listing day.

No comments:

Post a Comment