Online marketplaces like Amazon and Alibaba have been executing this tactic to great success. Singles Day, Black Friday, and Cyber Monday have been around for a while now, making the case for their inclusion to the official holiday calendar. According to Statista, Amazon, which holds its eponymous Prime Day sale in July each year, is expected to sell about USD 6.1 billion worth of goods this year. However, rivals like eBay and Walmart also organize their own sales to coincide with Prime Day. Here's how Amazon's festival of consumerism compares with that of peers.

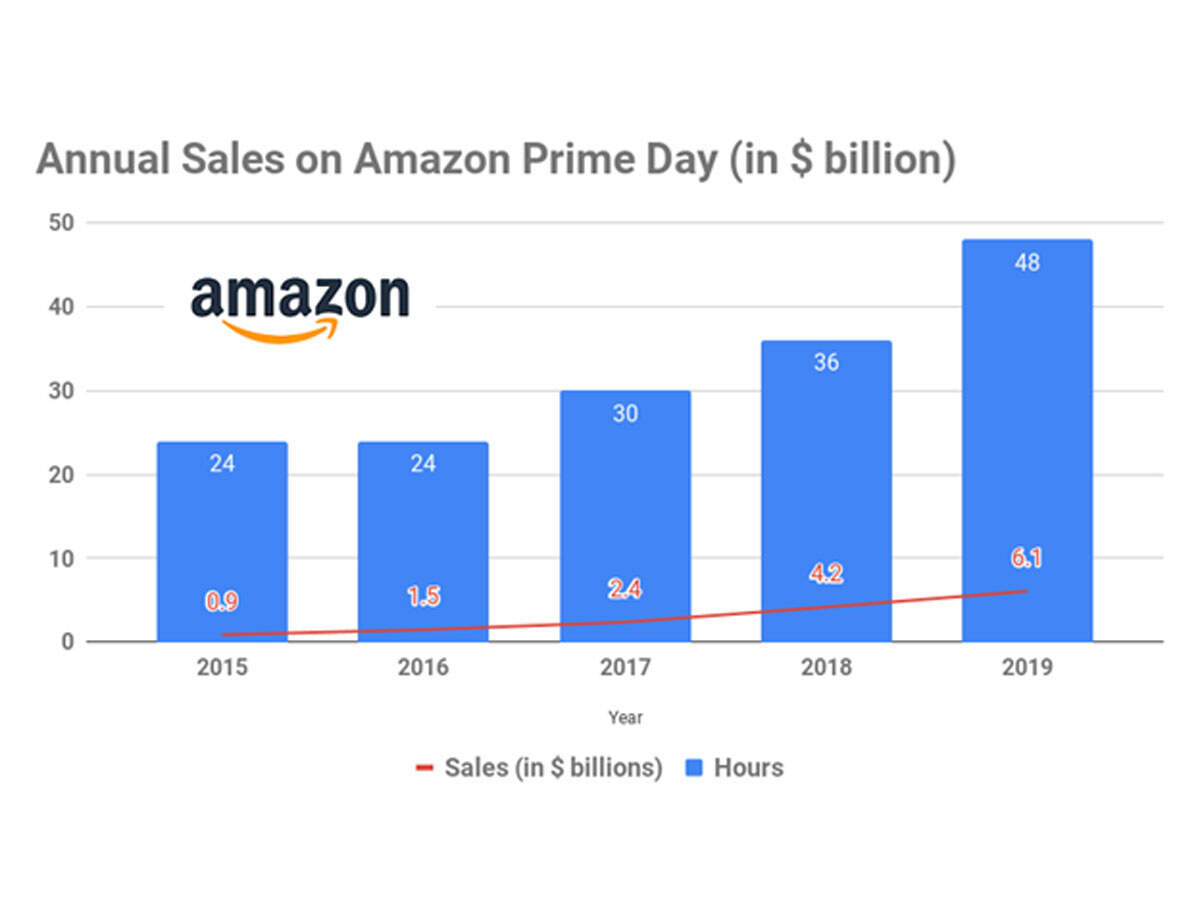

The 48-hour shopping window started out as a single-day affair in 2015. Global sale doubled after the hours of the sale was extended to 30 hours in 2017. Amazon does not provide data to records of transaction volume, but data compiled by Statista and Digital Commerce 360 reckon that this year's iteration will rake in USD 6.1 billion globally, an increase of 577 per cent. The sale is available to Prime members, serving as an incentive to sign for the package, which comes bundled with access to the company's video and audio streaming services, as well as swifter delivery.

Retailers have also warmed to the idea of Prime Day, despite the preponderance of heavy discounts, which could eat into their margins. According to internal data from independent market analyst RetailMeNot, a record 250 retailers listed wares on Amazon for Prime Day this year. This constitutes a 29 per cent increase over last year. The timing of Amazon's Prime Day also coincides with the end of summer.

Back-to-school shopping constitutes a sizeable chunk of sales, especially in the U.S. The discounts offered by Amazon have caused many brick-and-mortar retailers to mark down prices, especially in margin-sensitive product categories. However, the halo effect created by such big-ticket shopping festivals has helped boost spending on other platforms as well. Adobe has estimated a 79 per cent revenue bump for other retailers during Prime Day.

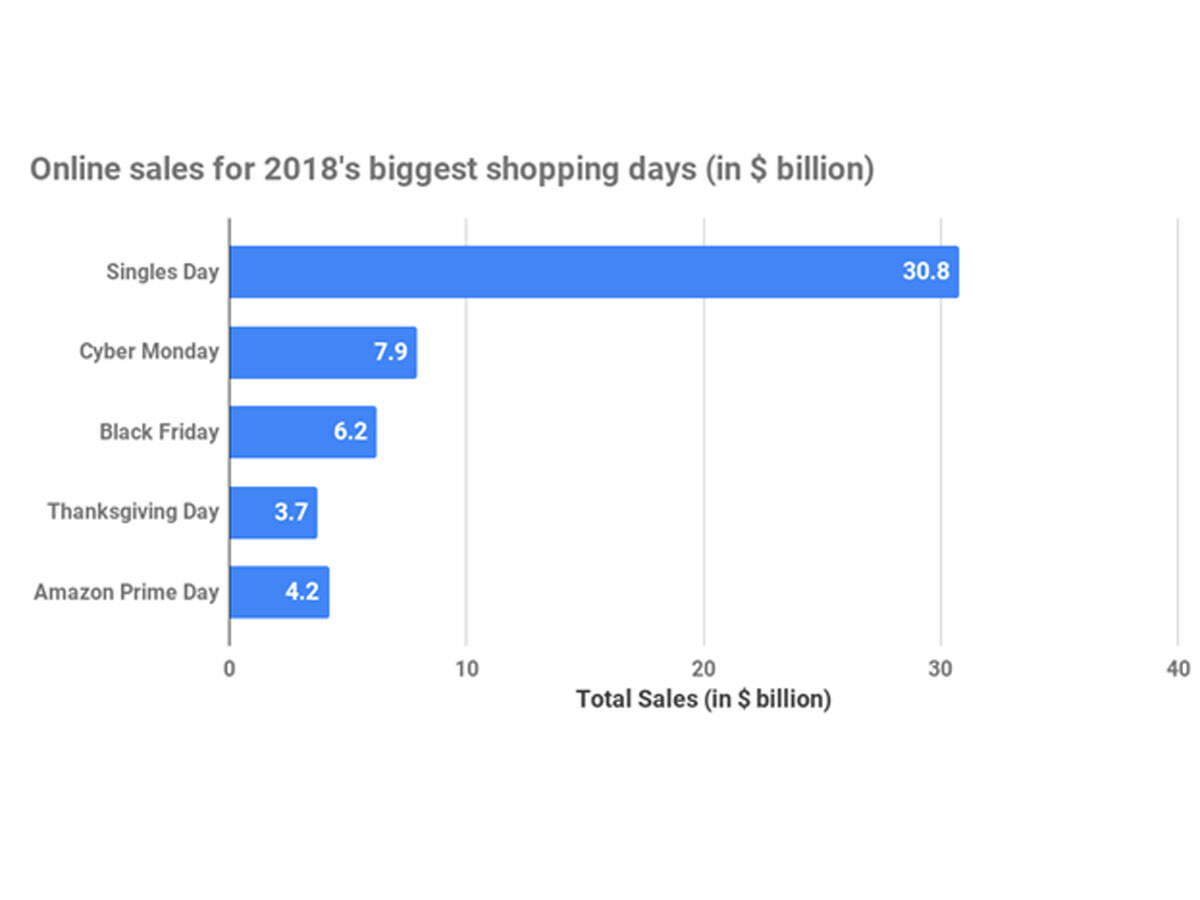

Recent data from China suggests that the country's economy is in a slowdown, but sales data from Alibaba's Singles Day suggests otherwise. Despite being a 24-hour event, the quantum of sales on the platform amounted to USD 30.8 billion last year, by far in excess of Amazon's modest sales on Prime Day.

Black Friday and Cyber Monday, which are tailored around the Thanksgiving holiday in the U.S. also saw significant consumer spending in 2018. However, despite being eclipsed by Alibaba, Amazon's overall revenue from the two-day event might be higher than estimates suggest. The Seattle-based company also acquires paid members to its Prime service, drawing more people to its ecosystem.

No comments:

Post a Comment