Sharanya travels thrice a month on work. Over the last two years, her life has become much easier with the proliferation of cheaper smartphones and mobile internet, enabling frequent fliers like her to book rides on cab aggregators such as Ola and Uber faster and for less. While she and millions of other women across Indiashould be celebrating this seamless connectivity, the 40-year-old marketing professional says she does not feel safe in most cabs, even in her hometown of Bengaluru.

Sharanya travels thrice a month on work. Over the last two years, her life has become much easier with the proliferation of cheaper smartphones and mobile internet, enabling frequent fliers like her to book rides on cab aggregators such as Ola and Uber faster and for less. While she and millions of other women across Indiashould be celebrating this seamless connectivity, the 40-year-old marketing professional says she does not feel safe in most cabs, even in her hometown of Bengaluru.Like several other women, she has had unnerving experiences to fuel her concerns. In May, Sharanya, who goes by her first name, says a cab ride home after 5 pm took an eerie turn when the driver kept eyeing her in the rear-view mirror. He then started asking her personal questions and having loud conversations with his acquaintances over the phone. A week later, she had another bad driver experience while in Delhi on work. The driver, for some reason, threatened to drop her off at a lonely stretch of an arterial road around 8 pm. He became abusive when she objected. “I complained on the aggregators’ apps. All I got were templated apology notes.” This has put her off even more. “I feel the internet market is hostile to women, despite the potential it has to reach new customers easily and cost-effectively,” says the marketing professional.

Kanika Iyer, a sales executive with a Gurgaon-based fintech startup, says the internet is of little help for women beyond cab rides and travel bookings. For example, she discovered that while her elder brother could easily find formal clothes online, few e-tailers understood fit and form for Indian women. While companies such as Ajio and Amazon have made some progress, the assortment and fit across categories such as western formals give men shoppers a disadvantage. “Despite the inconvenience, it is easier to shop in old markets in Delhi than hope to stumble across a dress or top that fits online,” she adds.

This does not bode well for internet commerce, a segment that promises explosive growth. Today, that growth is inequitable and mostly driven by what men want, giving less focus to the requirements of women.

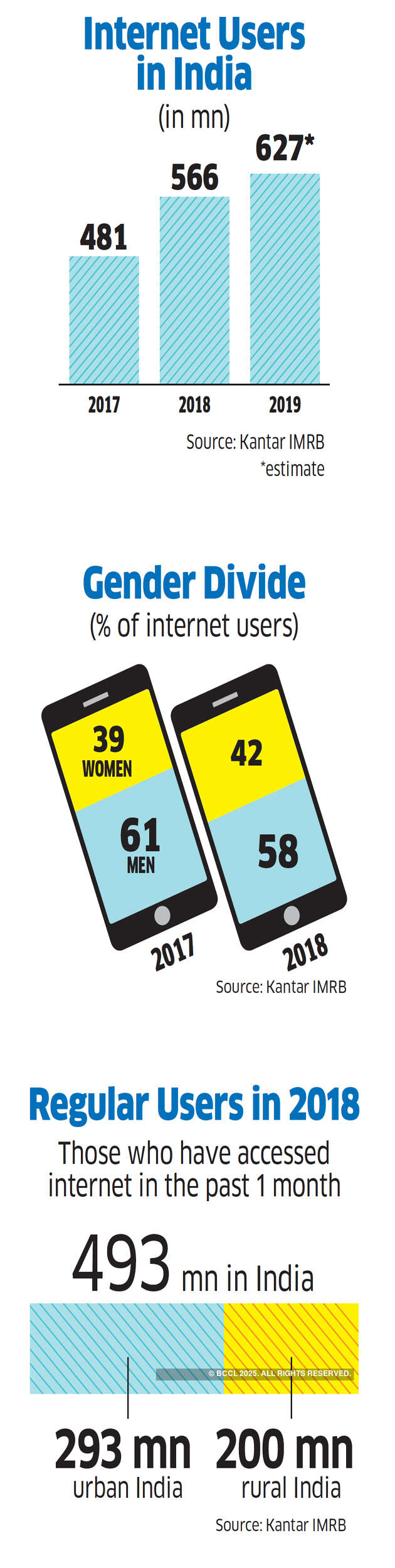

India’s internet economy will double to $250 million between 2017 and 2020, says management consultancy BCG. Internet users are expected to go up from 391 million to 650 million in that period. Many of these new users will come from beyond urban India. A key demographic missing from this storyline is women, though they make up about 48% of the population, according to the 2011 Census.

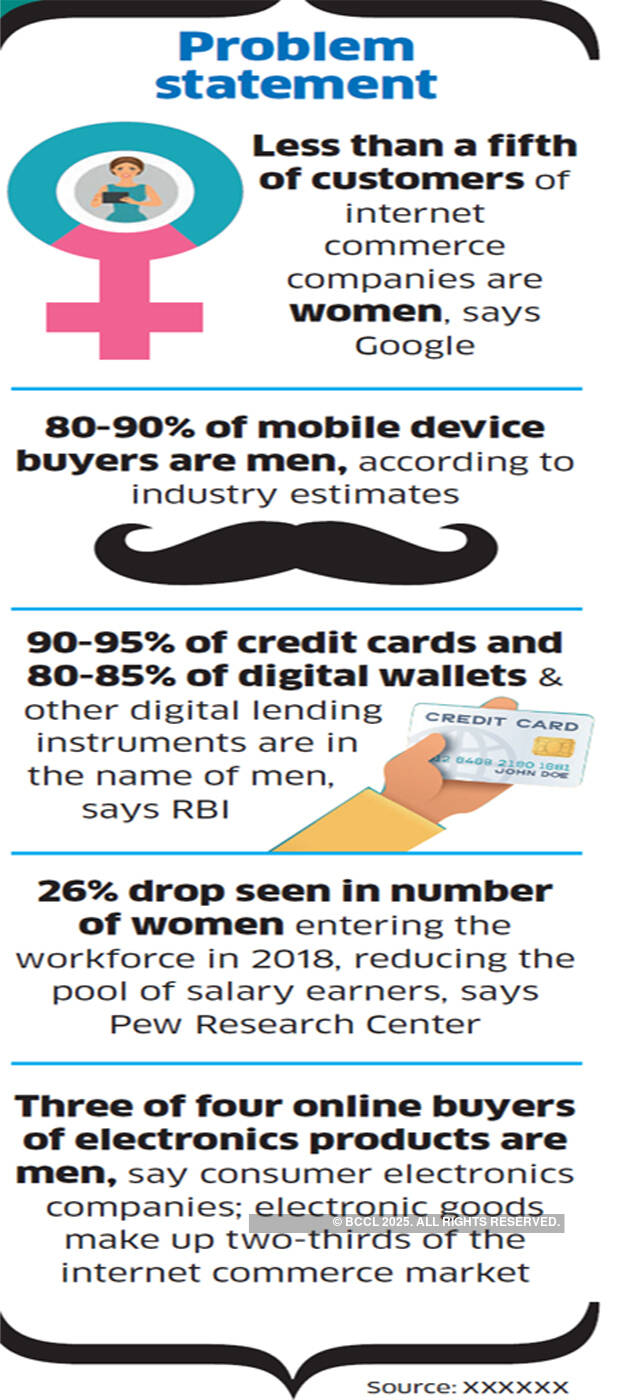

Conversations with consultants, investors and entrepreneurs show that the market has been designed with men as customers — two-thirds of India’s internet users are men. In key categories such as electronics (that accounts for 75% of India’s ecommerce market), nine of 10 buyers are men. Barely 10% of credit cards are in women’s names. They form an even smaller share of owners of new-age fintech products such as digital wallets. Women have been neglected as a target market, says Pallav Jain, country head, PayU Finance, a financial services and technology platform. More so in the financial segment. But, Jain says, the loan repayment rates are better among women than men. PayU hasn’t zeroed in on why that is so. “Even today, women are constrained from accessing capital and credit,” he adds. “Newer lending options are seeing better adoption, but there is a long way to go before we come close to gender parity.”

Conversations with consultants, investors and entrepreneurs show that the market has been designed with men as customers — two-thirds of India’s internet users are men. In key categories such as electronics (that accounts for 75% of India’s ecommerce market), nine of 10 buyers are men. Barely 10% of credit cards are in women’s names. They form an even smaller share of owners of new-age fintech products such as digital wallets. Women have been neglected as a target market, says Pallav Jain, country head, PayU Finance, a financial services and technology platform. More so in the financial segment. But, Jain says, the loan repayment rates are better among women than men. PayU hasn’t zeroed in on why that is so. “Even today, women are constrained from accessing capital and credit,” he adds. “Newer lending options are seeing better adoption, but there is a long way to go before we come close to gender parity.”

Women face multiple hurdles in India going online, including access to devices, a skewed market that promotes male-centric content and limited access to capital and credit to finance online purchases. Women who have overcome these challenges face other pitfalls — dating apps and sites being overrun by unruly men and under-cooked harassment redressal mechanisms, such as the one Sharanya faced. This leaves women users worried about their safety.

Some companies claim they take special steps to ensure women customers do not have any unpleasant experiences. “Furthering safety of women in shared public spaces and ensuring the freedom of mobility is among our key priorities,” says Pavan Vaish, head of central operations-India & South Asia, Uber. “We understand that women’s safety is a critical responsibility that we share with stakeholders within the safety ecosystem.”

But people like Sharanya say such utterances alone are not enough. More recently, a surge in video and chat apps has made some women worry about their digital privacy and safety.

Sachin Bhatia, a serial entrepreneur and an investor in internet businesses, says not only is there a huge disparity between men’s and women’s access to the internet, but the participation of women in the labour force is also down 26% in 2018, despite 470 million women being of working age in India. “Opportunities to reach out and engage have become limited.”

With internet users and content creators largely being men, women find themselves at a disadvantage. Women are being left behind, says Anindya Ghose, Heinz Riehl Chair Professor of Technology and Marketing at New York University’s Leonard N Stern School of Business. “While mobile connectivity is spreading quickly, it is not spreading equally. In low- and middle-income countries, women have less access to technology than men. The gender gap is wider in certain parts of the world: women in South Asia (including India) are 26% less likely to own a mobile phone than men and 70% less likely to use mobile internet.”

A Google study, Towards Gender Equity Online, released in April 2019 says four key factors hobble the presence of women online — access, content and community, privacy and safety. In terms of access, it isn’t just physical access to a connected device, but also the struggle to overcome (mostly male) perceptions about the dangers of women being connected, the “dangers” of women browsing content that could label them as promiscuous and the overt and covert limitations to going online.

Take the case of Ratna Kumari, a 25-yearold primary school teacher in Bengaluru who browses the internet using her smartphone. About 12 months ago, a stranger started sending her lewd messages on Whatsapp. This led to an uncomfortable situation at home, and her engineer husband now insists on tracking her online movements. He also forbids her from “wasting time” on social media. This meant limited time on her own terms to shop online or chat with friends.

Such issues stop women from creating content online, says the report. Being cautious may also have to do with privacy challenges. According to the Google study, 62% of women respondents got someone else to set up their phone; 53% of women are uncomfortable sharing phone numbers and 49% do not want to share their full names. The issue of safety is something women grapple with daily due to three main threats: cyberstalking, impersonation and personal data leaks.

Enough is clearly not being done to bring more women online, says Deep Kalra, cofounded of Makemytrip, which has 50 million active monthly users. “The gender skew is real. The gap widens further when it comes to high-ticket purchase items. If brands fail to strategise keeping women consumers in mind, they will do it at their own peril.”

He says the company has seen an uptick every year in enquires and bookings made by women for themselves and their families. “With more women joining the workforce, increasing discretionary income and growing aspiration of ‘have money, will travel’, we foresee a clear surge in the number of women booking trips online.”

Women are clearly making their numbers felt. The 2019 general elections, for example, saw equal number of men and women voters, a first in the country. Some companies in categories such as baby care, furniture, home furnishings and some services categories are aggressively catering to this target market.

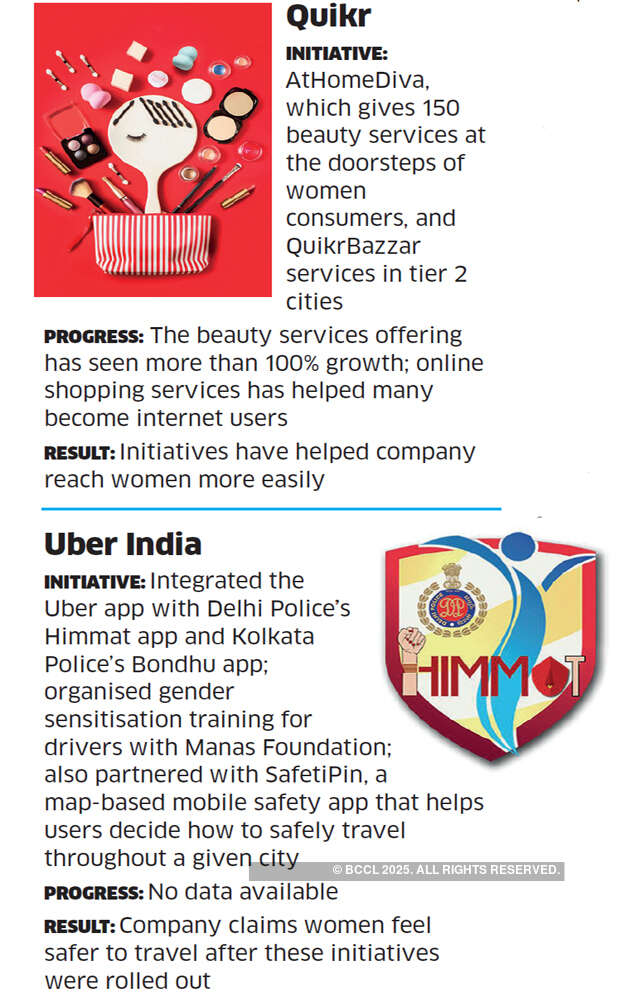

Vineet Sehgal, chief marketing officer at Quikr, the online services platform, says audiences are most relevant for home services, beauty services, jobs and home and lifestyle segments. To try to provide a broader set of services to women, Quikr is cross-selling for short-term and long-term needs of its consumers.

“We have also seen that a high number of women use our portal to apply for jobs in hospitality, BPO, data entry, front-office and sales,” he adds.

Professional services platform Urban Clap gets around 60% of its business from women. About 40% of its service providers are also women, says Abhiraj Singh Bahl, cofounder. While womencentric businesses in online fashion, home furnishings and baby care may have laid the groundwork to bring women online in India, newer offerings from the likes of Urban Clap, could catalyse a new and larger wave of women users in India.

Ride-sharing giant Uber has a partnership with Manas to provide gender-sensitisation training for drivers. Another partnership, with SafetiPin, a map-based app, tags safety scores to various locations in a city. To help address gender-based violence, Uber has integrated its app with Delhi Police’s Himmat app and Kolkata Police’s Bondhu app to complement the safety features. “For us, all the users (driver, rider, delivery partner) on our platforms are of utmost and equal importance,” says Vaish. “Uber is continually working with global experts to make the platform better.”

Global technology giants such as Google and Amazon are also queuing up to bring more Indian women online. Google has launched a drive, Internet Saathi, to increase internet adoption. The focus is on rural areas, where women find themselves disconnected from the web. The search giant, in association with Tata Trusts, has trained 58,000 “saathis” across 208,000 villages in 18 states, benefitting 22 million to date.

Google claims the women to male ratio of internet users in rural India has gone up from 1 in 10 in 2015 to 3 in 10 in 2017. Amazon, which has invested more than $5 billion in India, is focusing on discovery-led shopping for women customers. This will give its customers a personalised experience and help the company build greater engagement with them. Amazon data shows women have a 20% higher purchase frequency than men.

The interest in bringing more women online, particularly into transactions, can be seen in Facebook’s recent investment in social commerce startup Meesho, says NYU’s Ghose. “Facebook opened its marketplace in India last year. Given that Meesho is also operating in the same space, it makes sense for FB to look for a synergistic relationship. A significant proportion (80%) of Meesho’s user base is women. Social commerce has been a massive success in countries like China and South Korea. So it makes sense to explore similar unique solutions for the Indian market. The real growth in the coming years will come from women users.”

Serial entrepreneur and investor Bhatia says social media, especially Whatsapp, is increasingly becoming a great way to reach out and engage with women. Youtube videos on cooking, makeup, home improvement, life hacks, self-improvement and English-speaking, among others, are being lapped up by women audiences across the country, especially in local languages.

With the democratisation of information, women in smaller cities are consuming similar content as their counterparts in metros. Their aspirations are also becoming similar. Consider this data: the time users spend on Youtube videos on beauty tips has doubled year-on-year in 2018; there was a 40% growth in searches for beauty, mostly driven by women; and the top five voice searches for “how to make” are for lipstick, lip balm, aloe vera gel, soap and ice cream. “Clearly, enough data points towards women engaging a lot online,” Bhatia adds.

The challenges facing India’s internet economy are crystal clear: bring more women online and get women using the internet to look beyond these typical categories and transact across the board.

No comments:

Post a Comment