This will make PhonePe the first non-bank to facilitate such transactions since the capital markets regulator Sebi and payments governance body NPCI allowed retail investors to make their offers through the hugely popular UPI channel. However, only banks were given the mandate to facilitate these transactions.

“Earlier, the customers had to provide their account details and IFS code to make their bids. The introduction of UPI based payments will make the process much simpler as now they only have to provide their UPI IDs to block their funds,” said Hemant Gala, head of payments, banking and financial service, PhonePe.

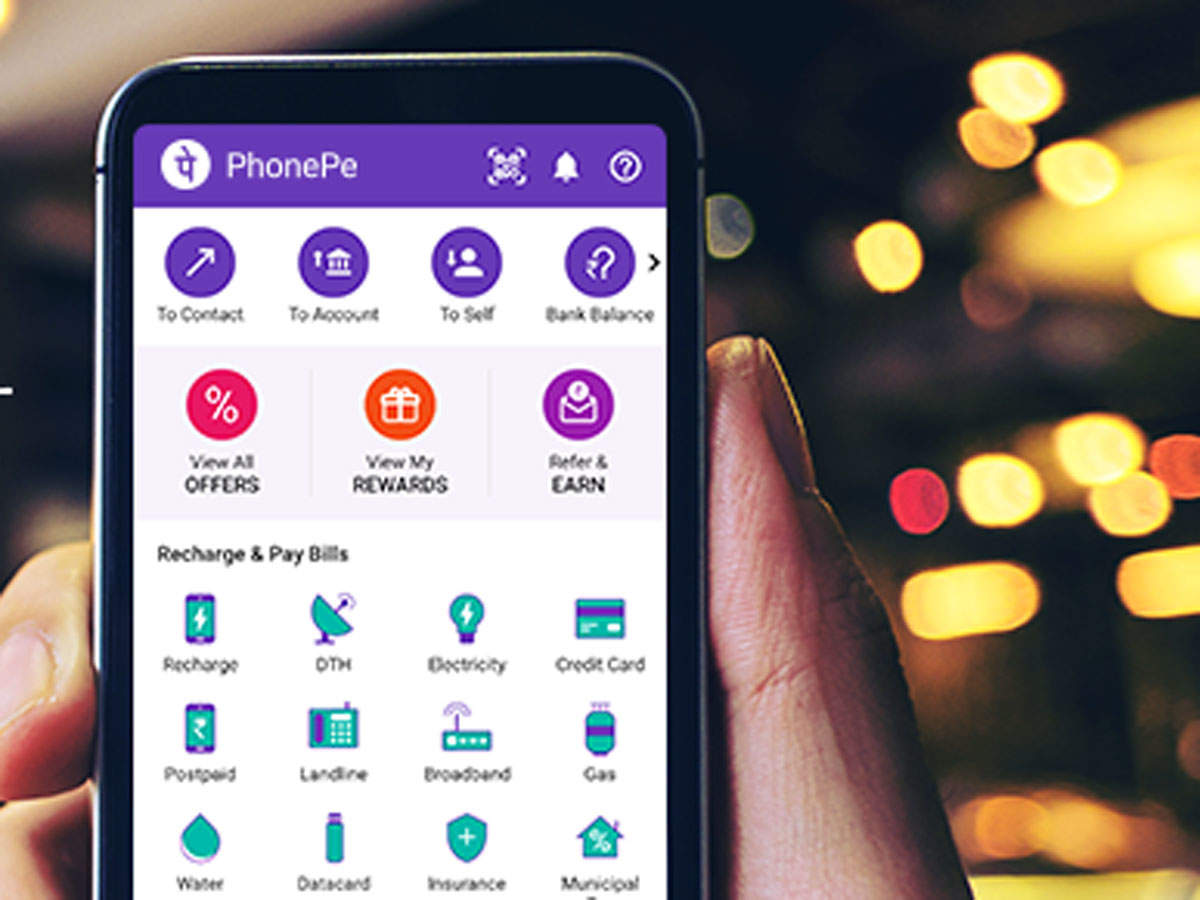

The overall customer base of UPI users is estimated to be more than 400 million, with about 918 million transactions processed just in the month of August. About 90% of these transactions were processed by either Paytm, Google Pay or PhonePe. The option for these customers to make payments through their preferred UPI application would make the IPO process simpler and more accessible to retail investors.

“Our USP has always been opening up new use cases and this is another such use case. NPCI can harness our distribution network of 150 million users,” Gala said.

As per the process guidelines, investors will have to fill in the bid details in their IPO application form as per the existing process along with their Virtual Payment Address (VPA), also known as the UPI ID, linked with their bank account. Upon validation of block request by the investor, the information would be electronically received by the investor’s bank, where funds equivalent to the application amount would get blocked.

“In the first phase, the process will take up to T+6 days for completion, but we are working on bringing it down to three days in phase two, and even lower in the future,” said Gala.

NPCI last year had launched UPI 2.0, an upgrade that allowed customers to block funds for future transactions acting as a substitute to the existing ASBA process through which bidders earlier blocked their funds.

“The new process has made applying for IPOs extremely convenient for retail investors by increasing efficiency, eliminating the need for manual intervention and logistics at various stages. We look forward to similar collaborations in the future, with a goal to make the process completely digitized,” said Praveena Rai, Chief Operating Officer, NPCI.

No comments:

Post a Comment