Every year, e-commerce players, including Flipkart and Amazon, host exclusive sales by offering quality products at ultra reasonable prices.

Every year, e-commerce players, including Flipkart and Amazon, host exclusive sales by offering quality products at ultra reasonable prices.However, an economic slowdown has spread wide-spread gloom across sectors with questions being raised about sales growth of ecommerce platforms this festive season.

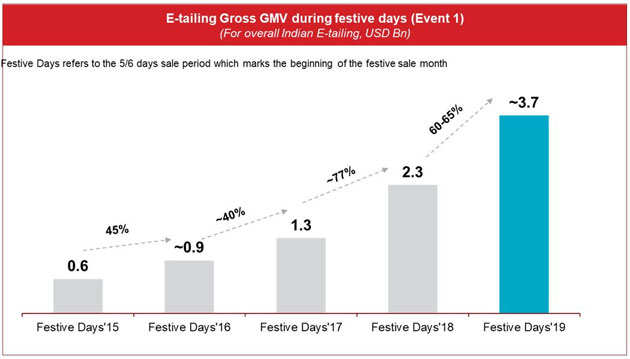

Contradicting many, consulting agency Redseer, in its latest report, revealed that 60-65% year-on-year growth can be expected from the festive season 2019. According to the report, e-tailers are expected to earn a gross sales of $3.7 billion (approx Rs 24,000 crore) between September 29 to October 4, the days dedicated to the annual festival sales of both Amazon and Flipkart this year.

Over 75 million gross transactions are expected over the 6-day festive period. For the whole festive month, sales might cross $7 billion (approx Rs 45,000 crore) which is 60-65% growth from last year. While the GMV last year stood at $2.3 billion during the festive days highlighting a 77% growth from 2017, the sales for the whole festive month stood at 45%.

(Source- Redseer)

(Source- Redseer)A 60% jump in the number of online shoppers is also expected from 20 million last year to 32 million this year, says the report. A majority of these shoppers are expected to be from Bharat or Tier-II cities, indicating breaking of vernacular problems and last-mile deliveries. However, this also hints at slower the growth as 2018 saw the number of online shoppers rise by 5 times compared to 2017.

In an interesting development, a willingness among customers to buy smartphones during the festive period may be slightly lower than last year. As per the survey, 40% of respondents mentioned that they will be purchasing consumer electronics and fashion items. In 2018, mobiles accounted for 56% of the GMV of festive sales.

Anil Kumar, Founder and CEO, RedSeer Consulting, said, "Our research clearly indicates that the market is ready to grow significantly during festive days 2019. This will be driven by strong demand from shoppers, especially from Bharat." Kumar says this is largely due to a strategy adopted by the ecommerce platform to focus on smaller towns and cities to increase their base. The industry has been focusing and investing on multiple themes like vernacular, credit availability, wide selection and fast shipping, which is expected to bear fruit this sale season. "The event is likely to mark a landmark for the industry as it democratizes to reach new consumer segments and new categories over the next few years," says Kumar.

(Source - Redseer)

(Source - Redseer)Last year, a Barclays report stated that Amazon's GMV surpassed Flipkart at $7.5 billion, with Flipkart's GMV standing at $6.2 billion in FY2018. However, Amazon lagged behind in terms of revenue at $3.2 billion and Flipkart at $3.8 billion. Further, Flipkart accounted for over half of the GMV of the entire e-commerce industry.

Earlier this month, it was reported that e-commerce sales are likely to witness a slump owing to the economic slowdown and e-tailers cutting discounts. According to a market research firm Kantar, consumer spending on e-commerce sites was estimated to have declined about a fifth in the first-half of the year to June.

However, both Amazon and Flipkart has denied this. In a recent report by ET, Kalyan Krishnamurthy, Group CEO, Flipkart, said the company has not witnessed any signs of a slowdown before the annual festive sales. He added that the firm is looking forward to clocking sales worth $3 billion this festive season.

When asked if sales growth in any categories is plummeting, Manish Tiwary, Vice President, Category Management, Amazon India, told ET, "In the last three to four months, we have witnessed an acceleration in the number of sellers wanting to register, starting from local artisans, weavers to large sellers and brands. In fact, they are lining up new products for the festive season and customers can choose from over 200 million products this festive season."

Tiwary added that Amazon India expects the Great Indian Festival to be its biggest ever in terms of traffic, new customers, digital payment adoption and sales.

"These events help us bring the next 100 million customers online, many of these from tier 2, 3 or even 4 towns and we remain focused on ensuring they get the best selection & shopping experience, irrespective of where they reside in the country," he said.

No comments:

Post a Comment