BENGALURU/MUMBAI: Digital payments company Paytm is in talks to acquire Mumbai-based insurance marketplace Coverfox for $100-120 million in an allcash deal, said two people aware of the matter. If the transaction goes through, it will be the largest acquisition by the Vijay Shekhar Sharma-led company, which is making inroads into the financial services segment through its subsidiary Paytm Money.

BENGALURU/MUMBAI: Digital payments company Paytm is in talks to acquire Mumbai-based insurance marketplace Coverfox for $100-120 million in an allcash deal, said two people aware of the matter. If the transaction goes through, it will be the largest acquisition by the Vijay Shekhar Sharma-led company, which is making inroads into the financial services segment through its subsidiary Paytm Money. This will also see Paytm emerge as a direct competitor to the country’s largest online insurance marketplace PolicyBazaar. SoftBank Vision Fund, a large investor in Paytm’s parent One97 Communications, is also a significant shareholder in Policybazaar, which may pose challenges to the deal, people close to the development said. “The Paytm board is in the process of finalising the contours of the deal,” said one of them.

Coverfox in Talks to Raise $50 million

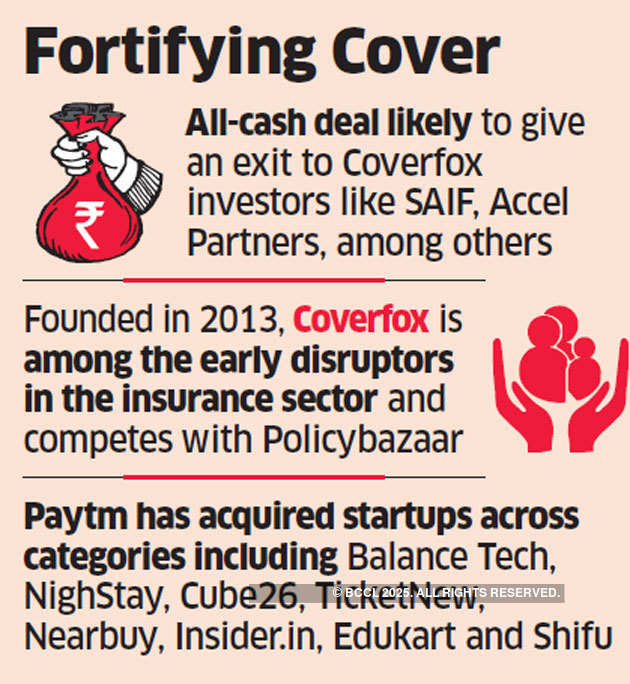

“There is still a chance that it may fall through as the board deliberates on the pros and cons of the transaction,” the person added. In all, Coverfox has raised $40 million in capital and counts SAIF Partners, Accel Partners, NR Narayana Murthy’s Catamaran Ventures and International Finance Corporation among its investors. These shareholders are expected to get an exit if the deal takes place. SAIF is a common investor in Paytm and Coverfox.

Founded in 2013 by Varun Dua and Devendra Rane, Coverfox has been in talks to raise a $50 million series D round even as the acquisition talks have been going on in parallel, another source said. Dua moved out in 2017 to head Acko, a new-age insurance firm that competes with the likes of Digit Insurance, which is backed by Canadian billionaire Prem Watsa’s Fairfax Holdings.

Founded in 2013 by Varun Dua and Devendra Rane, Coverfox has been in talks to raise a $50 million series D round even as the acquisition talks have been going on in parallel, another source said. Dua moved out in 2017 to head Acko, a new-age insurance firm that competes with the likes of Digit Insurance, which is backed by Canadian billionaire Prem Watsa’s Fairfax Holdings.Coverfox offers both life and non-life insurance policies. It has 50,000 agents and offers products from 45 insurance companies. The company sold premiums worth $100 million through its platform and generated $22 million in revenue with a million transactions done last year. Having started off by selling motor insurance, Coverfox wants to push term and life insurance products in the future driven mainly by its offline agent base.

Paytm’s Sharma and Coverfox CEO Premanshu Singh didn’t respond to ET's queries.

Paytm money push

After gaining a foothold in the digital payments business, One97 Communications launched Paytm Money in September 2018 with the intention of cornering the online mutual funds market. Having started with around a dozen asset management companies (AMCs), it now has all 40 in the country on board, offering direct mutual funds to clients. Paytm doesn’t reveal total assets under management but crossed the 1million user mark within six months of its launch in January 2019, the company has said. Paytm Money competes with the likes of ET Money, owned by Times Internet, a part of the Times Group, which publishes this paper, Zerodha, FundsIndia and Scripbox.

Since its launch, Paytm Money has diversified into stock broking. Having received a broking licence it intends to become a full-stack personal financial management application. In an earlier conversation with ET, Paytm's Sharma had said that insurance is a big area of focus for the company and it will look to expand its personal finance portfolio to shore up margins currently lacking in its core digital payments business. Paytm is already a registered corporate agent for all forms of insurance products as per the Insurance Regulatory and Development Authority of India.

No comments:

Post a Comment