NEW DELHI: IndiaMART InterMESH, the provider of India’s largest online B2B marketplace for business products and services, will hit the primary market with its initial public offer (IPO) on Monday. On the table are 48,87,862 shares in the price band of Rs 970-973. At this price band, the offer size stands at Rs 474-475.50 crore.

NEW DELHI: IndiaMART InterMESH, the provider of India’s largest online B2B marketplace for business products and services, will hit the primary market with its initial public offer (IPO) on Monday. On the table are 48,87,862 shares in the price band of Rs 970-973. At this price band, the offer size stands at Rs 474-475.50 crore.The first public issue by any company under Modi 2.0 is an offer for sale (OFS) and, hence, the company would not receive the proceeds.

At the upper limit of the price band, this play on India’s wholesale online market, trades at 34.02 times its FY18 basic EPS of Rs 28.60, and 48.12 times diluted EPS of Rs 20.22.

Here are a few details of the IPO issue you must know:

Business activity

The company primarily operates through its product and supplier discovery marketplace, www.indiamart.com. The online marketplace provides a platform for business buyers to discover and contact suppliers of business products and services. Data showed IndiaMART had an aggregate 723.5 million visits in FY2019, of which 550.3 million comprised of mobile traffic, which is 76 per cent of the total traffic. Besides, buyers on the website locate suppliers by viewing a webpage containing the supplier’s product and service listings, or by posting requests for quotes.

Size

The company enjoyed 60 per cent of market share in online B2B classifieds space in India in FY17, according to KPMG. As of March 31, 2019, the company had 82.70 million registered buyers and had 5.55 million supplier storefronts in India. These Indian supplier storefronts had listed 60.73 million products, of which 76 per cent of goods comprised products and 24 per cent were services.

Agfa HealthCare India, Case New Holland Construction Equipment (India), Hilti India, JCB Indiaand Nobel Hygiene are a few big suppliers on the company’s marketplace. The top 10 per cent of customers accounted for 40 per cent of the company’s revenue in FY19.

A total of 156.84 million, 289.98 million and 448.97 million business enquiries, respectively, were delivered to IndiaMART suppliers in fiscals 2017, 2018 and 2019. The company said it received 52.59 million and 72.52 million daily unique buyer requests in 2018 and 2019, respectively, of which 52 per cent and 55 per cent were repeat buyers calculated on the basis of the past 90 days, respectively.

Peers

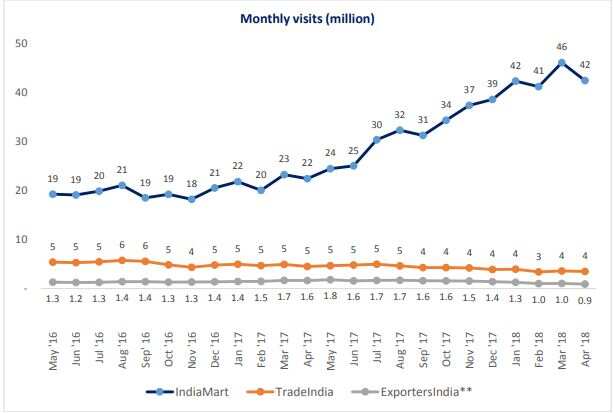

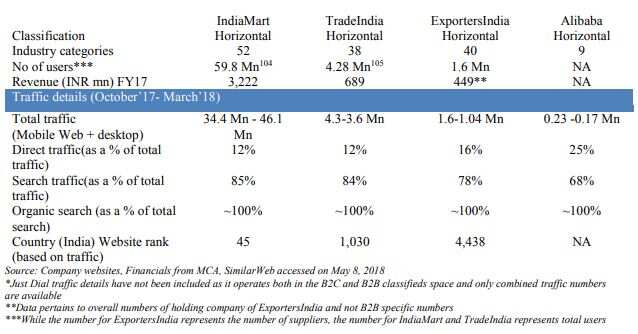

The company said it does not have any listed peer in India. Among non-listed peers, TradeIndia, Exporters India, Alibaba India and JD Business, are some of its online B2B classified platform peers. Just Dial, Google and other search engines, B2B transaction-based platforms such as Industry Buying Power2SME, Moglix sand Bizongo are some of the company's indirect competitors.

Here is a comparison of some of the key KPIs of the close peers:

Performance

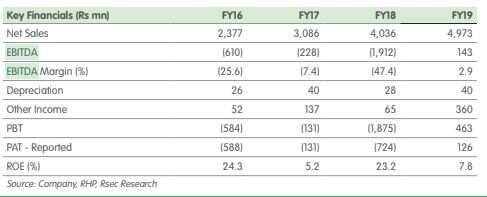

The company saw turnaround in FY19 when it reported a profit of Rs 12.6 crore against losses of Rs 72.40 crore in FY18, Rs 12.1 crore in FY17 and Rs 58.8 crore in FY16. Ebitda margin for FY19 was mere 2.9 per cent. That said sales have more than doubled to Rs 497.30 crore in FY19 from Rs 237.70 crore in FY16.

Company strategy

The company is planning to increase the number of free and paying subscription suppliers, improving supplier engagement, services, retention and monetisation. It plans to upgrade existing technology and support infrastructure to handle high user volume. It intends to invest in mobile platforms and capabilities and attract large suppliers and leading brands while growing core SME segment supplier base.

Industry outlook

The wholesale market in India is estimated to reach $700 billion in 2020 from $300 billion in 2015.

To tap into this potential, B2B e-commerce players have started building platforms for SMEs and traders, according to KPMG.

The internet penetration and mobile usage is expected to grow rapidly, and the market conditions are also made favorable by the government initiatives such as “Make in India”, which encourages increased manufacturing in India, “Digital India”, which promotes improved online infrastructure, connectivity and technological empowerment, integrated payment initiatives including United Payments Interface and the Aadhaar biometric ID system to boost online and mobile transactions.

No comments:

Post a Comment