BENGALURU: Udaan, an ecommerce platform for businesses, has raised $585 million from a clutch of investors, one of the largest late-stage rounds this year, valuing the company at nearly $2.8 billion.

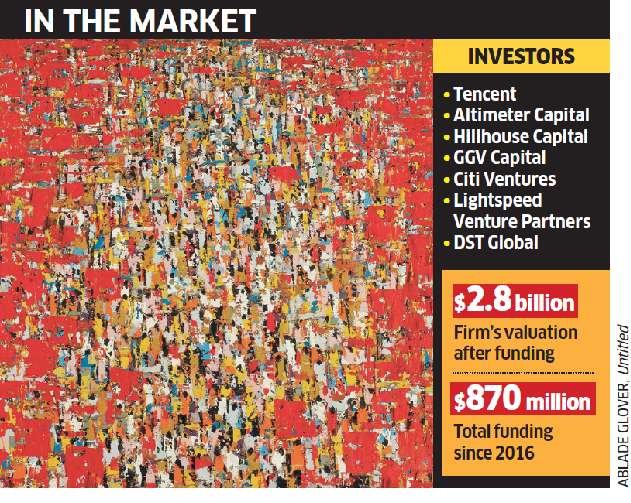

BENGALURU: Udaan, an ecommerce platform for businesses, has raised $585 million from a clutch of investors, one of the largest late-stage rounds this year, valuing the company at nearly $2.8 billion.Tencent, Altimeter Capital, Hillhouse Capital, GGV Capital, Footpath Ventures and Citi Ventures led the investment, with existing investors Lightspeed Venture Partners and DST Global also participating.

ET first reported the development on July 29.

Udaan last raised $225 million in September 2018, led by DST Global and Lightspeed Venture Partners, making it one of the fastest startups to achieve Unicorn status. Unicorns are startups that are valued at more than $1billion.

The Bengaluru-based company — founded by former top Flipkart executives Vaibhav Gupta, Amod Malviya and Sujeet Kumar — is an emarketplace that helps retailers purchase goods from wholesalers and traders, across categories including apparel, electronics, pharmacy, staples, fresh food and fast-moving consumer goods.

Udaan has three million retailers across 900 cities and connects them to 25,000 sellers across 200 cities. It offers supply chain, lending, payments and marketing capabilities, enabling these sellers to source from large manufacturers and distributors.

“We will continue to focus on growing the marketplace — adding more buyers, sellers, bringing in more categories on the platform and investing around building capabilities in fulfilment, delivery, lending, marketing, category management and core technology,” cofounder Gupta told ET. “We believe you cannot solve trade for SMEs without thinking holistically about supply chain, lending and payments.”

The company is estimated to be clocking $2 billion in annual gross merchandise value or GMV. It did five million orders last month.

India, unlike a lot of global economies, has a largely fragmented base of retailers and small businesses, which contributes $800 billion-$1trillion to its economic growth.

Smartphones and internet connectivity allow even the smallest retailers to seek advantage of scale, analytics, financial inclusivity and procurement. That, along with structural changes in the economy, including the introduction of a goods and services tax, Unified Payments Interface and fulfillment,has further fuelled growth of this sector.

The opportunity to cut out middlemen, tap into big basket sizes, and repeatability in purchases make the sector attractive for investment.

“Empowering… small businesses to more effectively procure and sell goods is not only a massive business opportunity, but will help transform the economy by providing internetscale productivity gains to merchants, wholesalers and manufacturers,” said Brad Gerstner, CEO of Altimeter Capital.

After it got an NBFC licence, Udaan started lending on its platform in November, on the premise that local kirana shops have traditionally been restricted to the local wholesale market due to their inability to get credit elsewhere.

“Udaan represents a powerful example of how technology can empower the business of small merchants, improve the efficiency of industries and bring benefits to consumers,” said Martin Lau, president of Tencent.

No comments:

Post a Comment