BENGALURU: India’s biggest online marketplaces, Flipkart and Amazon, have both claimed leadership in the hotly contested festive season sales with top company executives attributing the spurt in growth to new customers from smaller towns and cities.

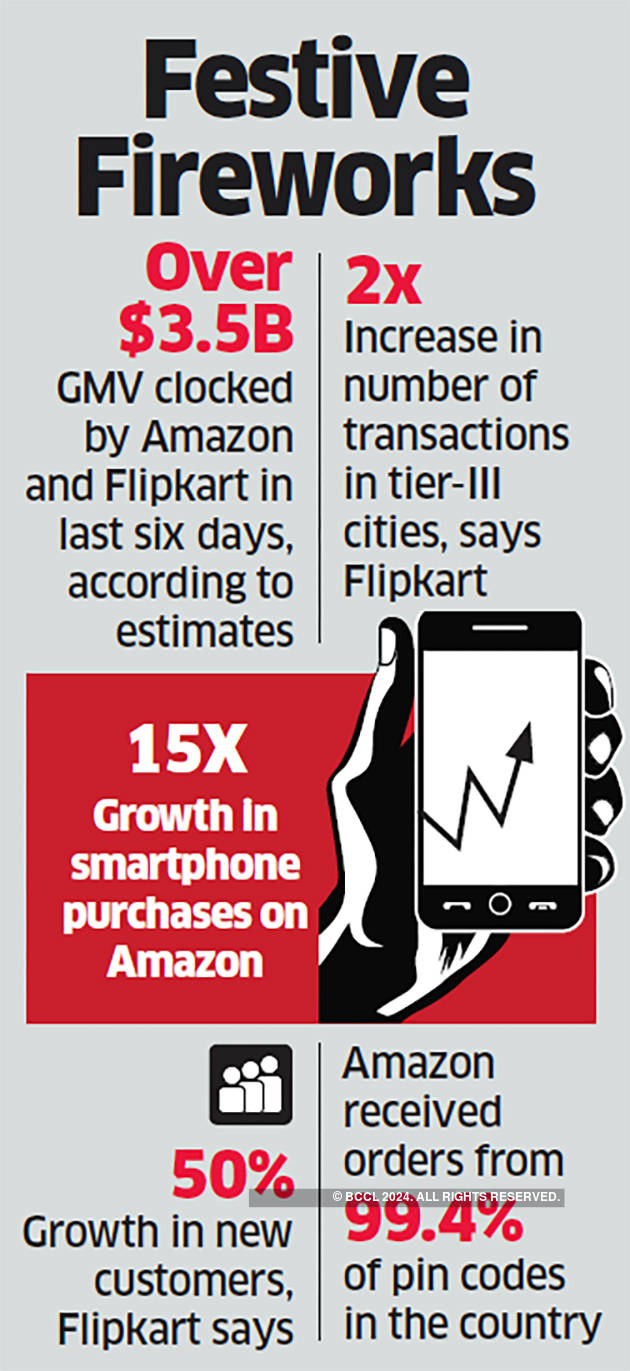

BENGALURU: India’s biggest online marketplaces, Flipkart and Amazon, have both claimed leadership in the hotly contested festive season sales with top company executives attributing the spurt in growth to new customers from smaller towns and cities.ET spoke to a cross-section of analysts, brands, and logistics companies who estimate that gross sales of both companies together is $3.5-3.7 billion over the last six days, a rise of 33% over last year.

Amazon India head Amit Agarwal, said the company recorded the highest share of transacting customers and purchases across all marketplaces in India. Agarwal quoted data from a syndicated report by market research agency Nielsen’s E-Analytic.

As per Nielsen’s findings, the Seattlebased etailer led the count of total transacting customers across categories with 50% share and had a value share of 46% during the festive sale, which began on September 29 and closed on October 4.

On the other hand, the Walmart-backed Flipkart notched up a market share of 73% during the six-day sale period, according to Kalyan Krishnamurthy, the Indian marketplace’s group CEO. Krishnamurthy cited his company’s internal data while claiming cities market leadership.

Flipkart and Amazon declined to share total sales numbers. ET could not verify through an independent third party the market share cornered by the two companies during the sale period.

The strong showing by both companies was driven by EMIs, other bank offers and wider reach across pin codes as well as affordable selections and launch of value-added services such as insurance, analysts said.

The festive season is regarded as critical for etailers, particularly as they have been dragged down by slower sales in the first half of the year due to changes in regulatory frameworks and an overall sluggish economy.

“We doubled our transactions in tier-III cities. Fashion, general merchandise and beauty categories did well with first-time shoppers,” said Flipkart’s Krishnamurthy.

“As we go deeper into tier-III markets, the average order value comes down,” he said, adding that customers, however, bought premium furniture and televisions enthused by new EMI schemes and exchange offers.

Analysts are of the view that this new throng of online shoppers have opted to use bank offers including affordable EMIs and attractive product exchange schemes to buy high-value items like electronics and appliances in smaller towns and cities where such inducements are rarely offered by offline retailers.

According to data shared by Amazon, three out of every four customers who availed financing options came from tier-II and III cities.

“We received orders from 99.4% of India’s pin codes, of which 88% customers were from smaller towns,” said Agarwal. For Amazon’s first-time shoppers, fashion was the biggest category, followed by smartphones and consumables, he said. Agarwal also said that customers from over 15,000 pin codes subscribed to its Prime membership — which he believes encourages the shopper to make repeat purchases from the platform.

Research firm Forrester estimates the domestic online retailers to collectively clock almost $4.8 billion in gross merchandise volume (GMV) during this crucial festive period.

GMV is overall sales clocked by an online marketplace and does not include discounts, returns, cancellations and cashbacks on products sold.

“The net sales will be about 15-20% lower, if we account for returns,” said a founder of a top logistics company that works with both players.

IT industry body Nasscom estimates the Indian ecommerce market was $33 billion in 2017-18 and reached $38.5 billion during 2018-19. Amazon and Flipkart comprise the bulk of the online retail market.

While shoppers from tier-III and IV cities have spent more during this festive season, they are clearly looking for value and better deals, say industry analysts.

“Consumer sentiment continues to be weak, and what we are seeing is people who have delayed spending in the last six months now buying during the sale, which is reflective in sales numbers,” said Satish Meena, senior analyst at Forrester Research.

Last week, Amazon said its India unit was on course to hit its internal sales target for the current year with its seller base clocking robust growth despite an overall slowdown in the economy.

The Big Billion Day sale, which is Flipkart’s annual shopping festival, and Amazon’s Great Indian Festival sale are flagship events for the etailers. This is also the most crucial time to shore up sales numbers since consumers plan big-value purchases in this period and are more open to spending on new items.

Thanks for sharing it.

ReplyDeleteERP Gold | Small Business Inventory Software