BENGALURU: Amazon has invested only Rs 2,800 crore in its India marketplace unit so far this year, one-third of what it did in 2018, even as the US online retail leader continues to build an omni-channel play by snapping up stakes in some of the largest offline retailers in the country.

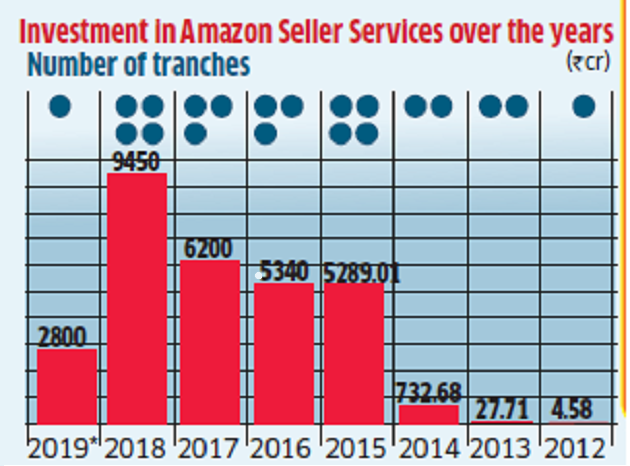

BENGALURU: Amazon has invested only Rs 2,800 crore in its India marketplace unit so far this year, one-third of what it did in 2018, even as the US online retail leader continues to build an omni-channel play by snapping up stakes in some of the largest offline retailers in the country.Amazon Seller Services, the India marketplace unit, received Rs 9,450 crore across four tranches last year, data from regulatory filings, sourced by paper.vc, showed.

Essentially, this will be the first time that Amazon’s yearly investment in its India marketplace would have come down since it set up shop in 2012, unless it makes up for the shortfall during the last quarter of the calendar year.

“The firm infused considerable capital (last year) in expanding its footprint, both in terms of services offered such as its Pantry as well, further strengthening supply chain to go deeper into India,” said Ankur Pahwa, national leader — ecommerce and consumer internet, EY India.

(Source: ROC, Paper.vc)

(Source: ROC, Paper.vc)Analysts tracking the retail sector said Amazon’s investments shot up last year as it sought to build its grocery business and the supply chain around that, traditionally a cash guzzler. This year, with the infrastructure already in place, requirements for capital would have been lower, they said.

Moreover, with its investments in offline retailers like Future Group, More Retail and Shoppers Stop starting to kick in, the requirement to build a dedicated supply chain might have come down, they said.

Amazon has said previously that it spends a large portion of its investment in India on building warehouses and other infrastructure for shipping.

“Amazon continues to infuse its committed investment of $5.5 billion in India as and when needed across its business entities. Most of the company’s investments in India are towards infrastructure build-out, technology, seller enablement programs and talent,” an Amazon spokesperson told ET.

Data sourced from paper.vc showed that Amazon has consistently grown its investment in its India marketplace, starting with Rs 4.6 crore in 2011 to Rs 6,200 crore in 2017, and touching Rs 9,450 crore in 2018.

While the company has other units, such as Amazon Retail India and Amazon Wholesale India, which supplement its core marketplace, Amazon Seller Services has attracted the lion’s share of the online retailer’s investment, which has cumulatively touched Rs 30,120.81 crore, or around $4.25 billion, at today’s exchange rate.

“It’s a function of utilising capital more efficiently because of the overall sentiment in India’s retail market,” said a source close to Amazon. “No large retailer in the country today has excess capital to spend, so Amazon is just doing the smart thing and conserving its cash.”

Other industry trackers said a glut in investment could be on account of Amazon rolling back on discounts, following the change in foreign direct investment regulations in December last year. They added that Amazon had done a good job in getting brands, banks and sellers to fund offers during the ongoing festive sales period.

Last week, Amazon Sellers Services almost doubled its authorised share capital to Rs 60,000 crore from Rs 31,000 crore, indicating that it might yet make fresh investments into its ecommerce marketplace.

No comments:

Post a Comment