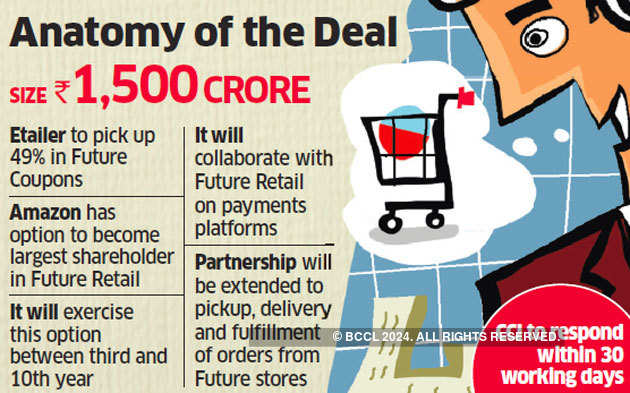

KOLKATA: Amazon has sought Competition Commission of India (CCI) approval for its proposed Rs 1,500 crore deal to acquire 49% of Future Coupons Ltd (FCL), a Future Retail promoter group company, even though it doesn’t have to, said two executives with knowledge of the matter.

KOLKATA: Amazon has sought Competition Commission of India (CCI) approval for its proposed Rs 1,500 crore deal to acquire 49% of Future Coupons Ltd (FCL), a Future Retail promoter group company, even though it doesn’t have to, said two executives with knowledge of the matter.Amazon wants to make sure that the transaction is in line with the tightened norms for foreign direct investment (FDI) in ecommerce, they said.

The US ecommerce giant’s investment arm, Amazon.com NV Investment Holdings LLC, which will be acquiring the stake, said in the CCI filing that it would acquire “voting and non-voting equity shares” of FCL in the proposed deal.

Amazon had used a similar structure while acquiring 49% in More supermarket stores — 17% of equity with voting rights and 32% without such rights — to ensure that the deal was compliant with the revised FDI norms.

While it couldn’t be ascertained whether the Amazon-Future group deal will have the same split, an industry executive said that FCL currently doesn’t have differential voting right (DVR) shares.

A Future Group spokesperson declined to comment as did Amazon. The FDI regulations issued in December, which came into effect from February, said that marketplaces should hold less than 26% equity with voting rights in any seller.

‘Paying a Premium for FCL Shares’

The norms also capped the amount of goods that an affiliate of the marketplace could supply to any independent seller on the platform.

An executive said Amazon is structuring the deal to ensure that Future Group will continue to be a seller and its private labels can be sold on the Amazon India marketplace.

“The proposed combination (read: deal) consists of certain other constituent steps involving FCL, FCRPL (Future Corporate Resources Ltd), and FRL (Future Retail Ltd),” Amazon said in its CCI application, a copy of which ET has seen. “It is submitted that each of the constituent steps of the proposed combination, including the acquisition of shares of FCL by the investor, on a standalone basis, are exempt transactions, and need not be notified to the Hon’ble commission.”

FCL, owned by Future Group promoter, the Biyani family, holds 39.6 million warrants in Future Retail, which when exercised, will convert into a 7.5% stake in the latter. The promoter group in total owns 47.02% in Future Retail that operates 295 Big Bazaar stores and about 1,600 neighborhood grocery stores, including EasyDay and Heritage Fresh.

Amazon has the option to become the largest shareholder in Future Retail and can exercise this call option anytime between the third and the 10th year. However, details haven’t yet been announced or notified in the CCI application.

Another executive said Amazon is paying a substantial premium for FCL shares to retain the option of becoming a dominant shareholder in Future Retail. “Amazon is paying around Rs 660 per share, which is around 65% premium to the current share price,” he said.

FCL is engaged in developing innovative value-added payment products and solutions such as corporate gift cards, loyalty cards and reward cards. The partnership will initially result in collaborations between Amazon and Future Retail on payment platforms and solutions and will eventually be extended toward pickup, delivery and fulfilment of customer orders through Future Group’s nationwide network of stores in 440 cities and towns across India.

No comments:

Post a Comment