Mumbai: Walmart’s top executives are betting big on its Indian payments enterprise PhonePe’s foray into digital ATM business to claim the top spot in the country’s increasingly competitive digital payments market where the global retailer faces stiff competition from peers Google, Amazon, Facebook and Alipay-backed Paytm.

Mumbai: Walmart’s top executives are betting big on its Indian payments enterprise PhonePe’s foray into digital ATM business to claim the top spot in the country’s increasingly competitive digital payments market where the global retailer faces stiff competition from peers Google, Amazon, Facebook and Alipay-backed Paytm.The recently-launched digital ATM feature by PhonePe plans to enable nearly 1 million merchants on the network to offer cash withdrawal services to customers who are nearby at a fee fixed by them.

“It’s a revolutionary solution with potential to transform cash in India,” said Judith Mckenna, CEO Walmart International, at the retailer’s post earnings presentation to analysts in New York on Tuesday. “If you think about it, there are only two lakh ATMs in India and this service will increase the capability to access cash by nearly five times soon.”

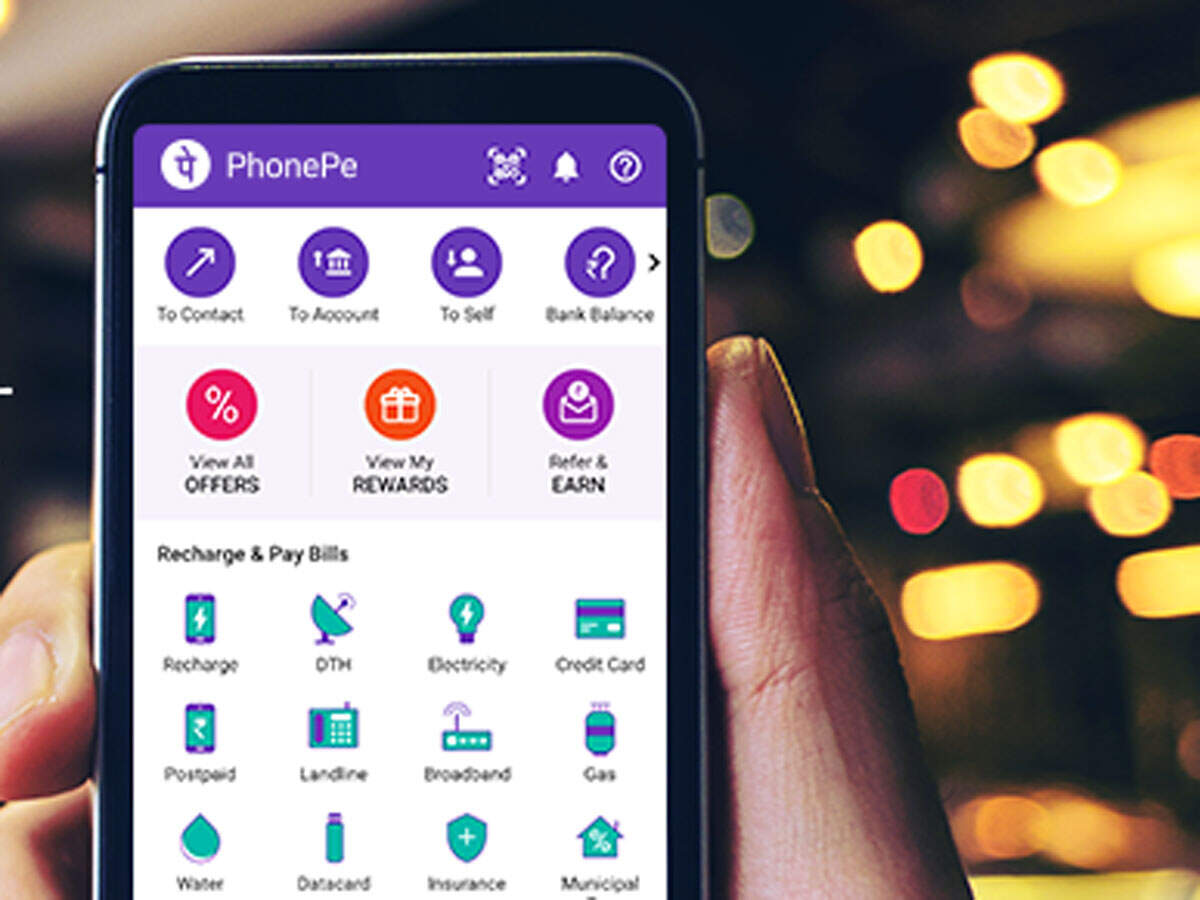

For this, the Walmartowned financial service provider has geotagged over 5 lakh merchants with excess cash to help customers convert digital money to cash through a ‘withdraw’ button on the PhonePe application.

The idea is to increase merchant engagement on the platform by creating a new value service for both local shop owners and consumers, Vivek Lohcheb, head of Offline Business Development, PhonePe, had told ET.

The leading payment player, in the absence of Merchant Discount Rates (MDR), believes including such value-added services to existing business channels would be the key to future growth in an already competitive market with the likes of Paytm, Google, and now Whatsapp, facing off to dominate merchant and customer engagement modes. Mckenna said Walmart’s ambition for PhonePe is to become “India’s largest transactional platform anchored in payments.”

Data she shared at the conference showed PhonePe’s annual payments value stood at $180 billion with nearly 20 million daily users on the platform. Together with Google Pay and Paytm, the trio corner over 90 per cent of UPI-based transactions in the country. Meanwhile, Walmart, which also acquired Flipkart in 2018, said its international business grew by 2.3 per cent to $33 billion.

No comments:

Post a Comment