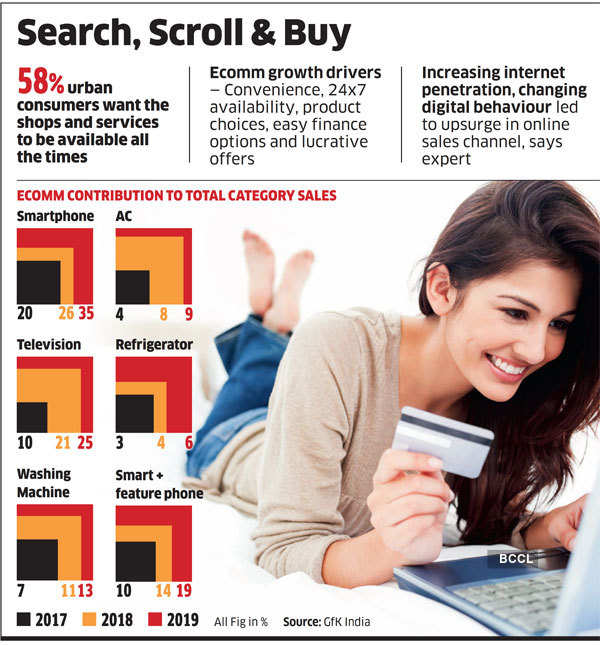

Kolkata: The contribution of e-commerce to smartphone, television, air-conditioner and washing machine sales has gone up in 2019 from the previous year, which marketers attributed to continued shift of consumption habit and plethora of price aggressive online launches. Latest data from sales tracker GfK India showed the contribution of e-commerce to total smartphone sales has gone up to 35% in 2019 from 26% in 2018. For overall mobile phone sales, which include feature phones, the contribution is up to 19% from 14% in 2018.

Kolkata: The contribution of e-commerce to smartphone, television, air-conditioner and washing machine sales has gone up in 2019 from the previous year, which marketers attributed to continued shift of consumption habit and plethora of price aggressive online launches. Latest data from sales tracker GfK India showed the contribution of e-commerce to total smartphone sales has gone up to 35% in 2019 from 26% in 2018. For overall mobile phone sales, which include feature phones, the contribution is up to 19% from 14% in 2018.For televisions, online sales now account for one-fourth of the total market, up from 21% in 2018 though the overall market declined 2% last year.

In white goods, e-commerce contribution has gone up by 1-2 percentage points in 2019. However, in the last two years, the contribution has almost doubled – 6% for refrigerators in 2019, up from 3% in 2017; 13% for washing machines from 7%; and 9% for ACs from 4% in 2017.

Haier India president Eric Braganza said e-commerce can continue to become a bigger channel for smartphones and TVs, but for appliances it may grow up to 12-15% and then stabilise due to touch-andfeel factor in purchase decisions.

GfK India’s MD Nikhil Mathur said upsurge in online sales channel can be attributed to increasing internet plus mobile penetration and changing digital behaviour. He said as per its study, 58% of urban consumers surveyed agreed that they need the shops and services to be available all the times.

“Convenience, 24x7 availability, product choices, easy finance options and lucrative offers ahead of new launches have oiled the growth engine for e-commerce. Offline channel continues to play an important role in human touch, personalisation and satisfaction of shopping experience. Omni-channel presence will also continue to play an important role for marketers,” Mathur said.

GfK is the only market intelligence firm in India which tracks actual sales to consumers unlike others, who track shipments that can include unsold stock as well. It recently released figures that showed sales growth of household appliances was best in three years.

The researcher said new entrants in durable space are first targeting online channel to establish foothold in India and then graduating to offline stores.

Online exclusive electronics brand BPL India COO, Manmohan Ganesh, said except for a few retailers, no one can match the wide product selection available online that is triggering the growth. “However, touch-and-feel is still important for appliances, even though such factors have disappeared for smartphones or TVs,” he said.

However, the growth of online sales has come down in 2019 compared to 2018 due to base effect, consumers yet to fully open their purses and the tightening of e-commerce norms by the government, industry executives said.

For television and home appliances combined sales, online sales growth rate came down to 30% last year from 107% in 2018. Growth of online sales of smartphones, however, remained insulated, reporting 45% growth in last two years each.

However, sales growth in e-commerce continued to outpace brick-and-mortar stores across categories in 2019 as well. GfK said for products like ultra HD TVs and smart TVs, the sales for 32-inch-plus screen sizes grew by 10% in offline stores versus 33% in online last year.

No comments:

Post a Comment