Flipkart, founded in 2007, redefined India’s internet commerce industry in a decade. It developed the cash-on-delivery model and made its own billion-dollar logistics unit in an economy rife with a fractured logistics system. After building a business up from scratch, the ecommerce company stirred up the market further in 2018 when Walmart acquired it for $16 billion. All this while, another potentially mammoth business was sprouting under its shadows.

Flipkart, founded in 2007, redefined India’s internet commerce industry in a decade. It developed the cash-on-delivery model and made its own billion-dollar logistics unit in an economy rife with a fractured logistics system. After building a business up from scratch, the ecommerce company stirred up the market further in 2018 when Walmart acquired it for $16 billion. All this while, another potentially mammoth business was sprouting under its shadows.The foundation of this business came from Flyte, the digital music and content business Flipkart tried to build in 2012. But the online music store couldn’t beat the odds. Neither e-wallets nor paying for music were widespread in India then. A bunch of other reasons also led to the venture closing within a year. But the lack of a smooth online payment process had planted the seeds of a potential money-spinner: a payments platform.

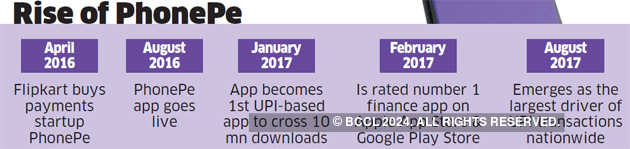

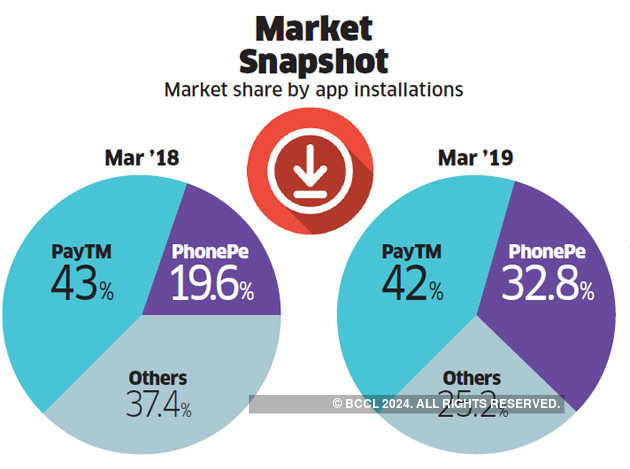

The brains behind Flyte, Sameer Nigam and Rahul Chari, used the learnings from their failed venture to exit Flipkart and set up PhonePe in 2015, hoping to ride the coat-tails of India’s exploding digital payments ecosystem. Their decision was vindicated in April 2016 when Flipkart acquired PhonePe. It has held its own even against market leader Paytm, which has funding from Alibaba Group and SoftBank. In March, Flipkart approved spinning off the mobile payment platform as a separate unit. PhonePe is now in talks to raise $1 billion, giving it a valuation of $7-8 billion.

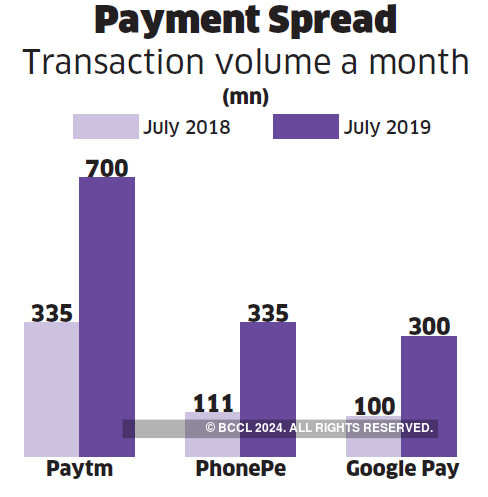

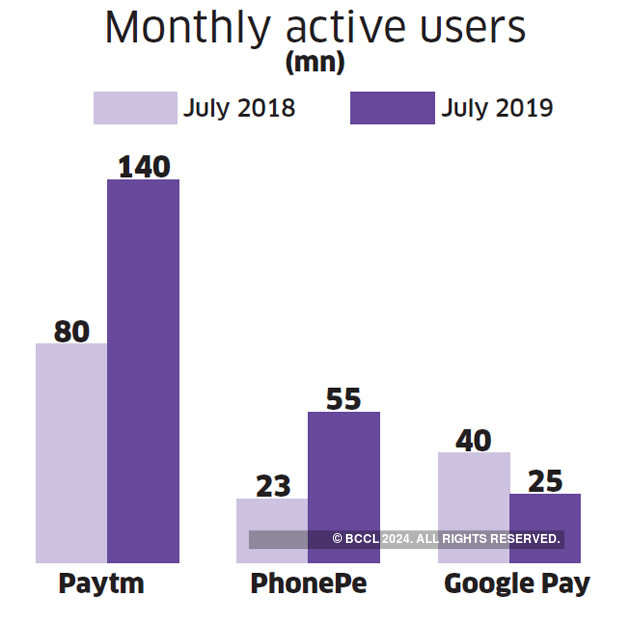

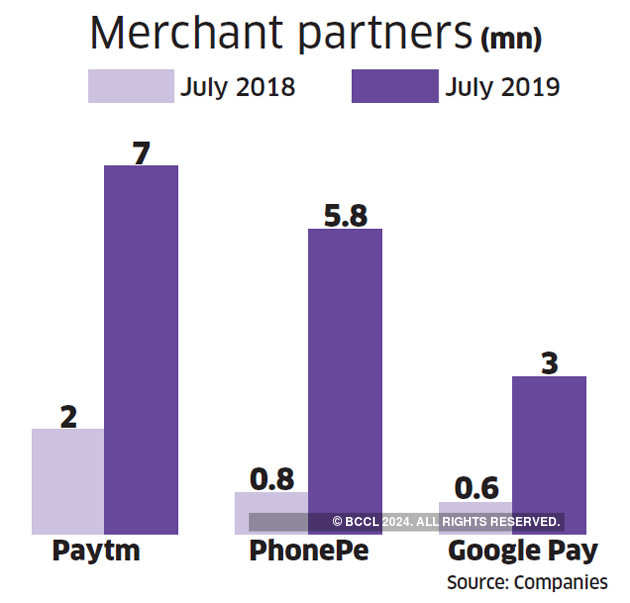

Flipkart’s bet is not unfounded. Nigam and Chari, who are back in the company where their idea had germinated, have grown PhonePe’s base rapidly. About 12 months ago, PhonePe had under 800,000 businesses on its platform. Today it has over 5.8 million and is adding nearly a million every month. It had 55 million monthly active users in June 2019, against 23 million in June 2018. PhonePe’s monthly transaction volume was 335 million at the end of July 2019 from 111 million in July 2018.

Market leader Paytm, in comparison, has over 350 million monthly active users in June 2019, against 120 million in June 2018. It has seven million businesses on its platform and logs a monthly transaction volume of over 400 million. Though the gap is wide, the competition has taken up the gauntlet. Paytm plans to take its transaction volume from 5.5 billion at the end of 2018-19 to 12 billion by 2019-20.

Market leader Paytm, in comparison, has over 350 million monthly active users in June 2019, against 120 million in June 2018. It has seven million businesses on its platform and logs a monthly transaction volume of over 400 million. Though the gap is wide, the competition has taken up the gauntlet. Paytm plans to take its transaction volume from 5.5 billion at the end of 2018-19 to 12 billion by 2019-20.

The challenge for PhonePe is not just getting more users, but also getting them to spend more on its platform. According to data from market intelligence firm Kalagato, HDFC Bank’s Payzapp topped the charts in terms of monthly average transactional value at Rs 2,743.3, Mobikwik was Rs 1,141.6 and PhonePe was third at Rs 973 in March 2019. However, Chari, who is the CTO of PhonePe, says that unlike the competition and the global investor community, PhonePe tracks other metrics such as daily active users as it builds the business. The company has slowed cash burn by reducing cashbacks and other handouts to bring consumers and businesses on board. “We focus on acquisition, retention and share of wealth,” he says.

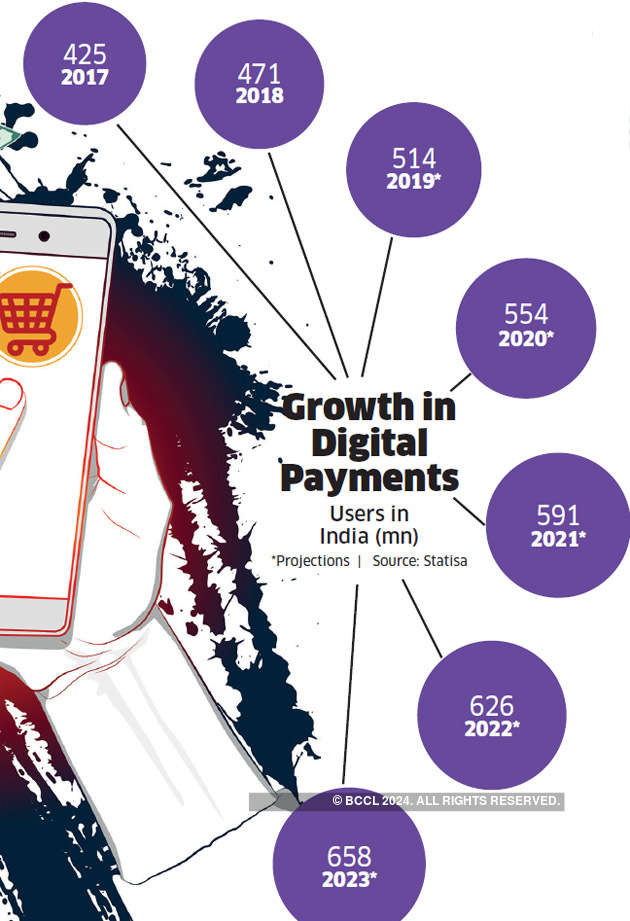

Payments business has a lot of scope to grow in segments as diverse as daily groceries and public transport, says Vivek Belagavi, partner-fintech leader, PWC India. This gives firms such as PhonePe room for growth in an underserved market.

This next stage of PhonePe’s evolution will see the company evolve into becoming a broader financial services player. “We will get into mutual funds, insurance and other such categories,” says Nigam, the CEO of PhonePe. “We also believe that the open banking system will accelerate, and we would like to play a role there.” However, the challenge for the firm is to look beyond these relatively low-margin offerings and make a splash into lending.

Vivek Belgavi, partner-fintech leader, PWC India, says these companies should have a wider offering to become profitable. “Sectors such as lending, wealth management and insurance are clear adjacencies for these fintech companies.” The focus is to use their original business to build a large customer base and then use newer offerings to build a moat around the payments business.

That is exactly PhonePe wants to do: leverage the data generated by its businesses to build a distribution pipeline for conventional lenders. “We are trying to build a fintech super app,” says Nigam. This means the payments platform will also be a one-stop shop for users uncomfortable visiting multiple apps. Users on the PhonePe app might soon get a window to directly access the services of IRCTC, Flipkart and Fasoos, among others, rather than visit each app.

Nigam is confident he has found the customer base. “There is one set of users, primarily in urban India, who are familiar with smartphones and are happy dealing with many apps. PhonePe will be the go-to app for all the needs of such users.”

Game of AppsSanjay Swamy, cofounder of early stage investor Prime Venture Partners, says smartphones and mobile data are a lot more pervasive in India today. But some segments may not be very conversant with downloading new apps and managing their usage and a super app may well appeal to them, he adds. If these plans fructify, PhonePe’s valuations would surge.

Keybanc Capital Markets, a market analyst tracking Walmart, says the fintech firm could soon be valued at $14-15 billion. In four years, it might be as valuable as its parent, Flipkart. Edward Yruma of Keybanc recently said digital payments at retail stores would grow 20% annually until 2023 and reach $135 billion. Peer-to-peer payments will add another $150 billion to PhonePe’s addressable market.

While Flipkart’s challenge was carving a path to success, PhonePe’s will be finding the right space in a market that has dozens of players. Some competitors such as Paytm and Google Pay have deep pockets. Besides, as fintech hasn’t percolated beyond small-ticket online payments, getting users beyond the initial 100 million would not be easy.

Some entrepreneurs such as Anand Kumar, founder of PayNearby, a fintech venture focussed on transforming small retailers into payment points, says one has to go beyond phones and apps. Transforming small stores into financial conduits for phone top-ups and insurance premium payments is the next gold mine. PayNearby has onboarded over 650,000 such retailers across 600 districts and 16,700-plus pin codes to enable such transactions even after banking hours. It also used the lack of widespread operational knowhow of apps among the rural populace to its advantage.

“These are the limitations of the digital self-service environment,” he says. The platform processes Rs 1,340 crore in remittances a month, mostly from unbanked migrant labours. It controls a third of the Rs 9,000 crore market in Aadhaar Enabled Payments Services, which provides basic financial services through low-cost devices maintained by business correspondents. Using this mass of data, PayNearby has applied for a NBFC licence to lend money to this market.

Nigam says: “In terms of excitement and interest in the space, digital payments and fintech are where ecommerce was around five years ago.”

Industry observers, however, say this leap will take some time. “Letting someone pay digitally for groceries online or a tender coconut on the street is very different from trusting someone with your wealth and savings,” says the CEO of a digital lending venture, who did not want to be named. “Payments companies are yet to build this trust.”

The founders of PhonePe agree. Chari, who is also the CTO, says there is a long road ahead. “Consumers need to spend and send before we can make significant inroads into other markets.” Nigam says the challenge facing PhonePe is that such apps are not thought of as a substitute for cash.

The founders want to grow PhonePe’s business on multiple fronts. While the firm started with a focus on cash transactions — blue-collar workers sending money home or urban millennials dividing a bar tab — it has progressed to what Nigam describes as phase 2 of the company’s evolution: zero in on consumer lending and pushing customers to use the PhonePe platform more. Nigam says the company is moving towards the third and fourth phases, which will involve helping people manage and grow their money.

The first move was made in June 2019 when PhonePe launched its wealth management offering. “We have a bunch of apps on our platform that lets startups, for instance, launch their business online cheaper and also track their inventory,” says Chari.

Payment fintech companies have started branching out, say experts. “Companies offering payment services in India have been able to create a vast customer base and expand their offerings to rural areas also. There is a strong need for the payment companies to diversify their revenue streams,” says Manish Jain, partner, digital and fintech, management consulting, KPMG in India. “Lending provides an opportunity for these companies to utilise their customer base and offer short-term credit.”

In PhonePe’s case, the opportunity is to lean on business ties with millions of small businesses — and not just to process digital payments, but to offer them credit lines to grow. “The payments space is likely to see consolidation due to the low-margin, high-volume nature of business. Some of the large players might look at other strategies of consolidation and acquisition to capture a larger share of the pie,” Jain adds.

There are 375 companies in payments, 338 in lending, 303 in wealth tech-retail and 58 in emerging fields, says consultancy Medici, putting the number of fintech startups in India at 2,035. Only a few will get funding and a fewer still will grow to any significant scale.

The need for a strong payment backbone has not been lost on PhonePe. Nigam and Chari experienced the problem firsthand in October 2014. A surge in traffic had crippled online payment gateways during Flipkart’s Big Billion Sale. This caused massive business disruption and frayed tempers all around. “It was quite apparent then that to become a multitrillion-dollar digital economy, the most important part — a payments system — wasn’t ready,” says Chari. The firm also had to keep pace with shifting consumer preferences — from online payments to mobile-first and driven by mobile-only.

“We quickly went from an online payment system that used seven or eight hops to no more than two,” Chari adds. A key driver for PhonePe’s success will lie in its founders and senior executives proving that it can sustain its growth as an independent entity.

No comments:

Post a Comment