BENGALURU: As many as 85% of Indian users install e-wallets and fintechapps like MobiKwik and Paytm, only to let them remain dormant, according to a study.

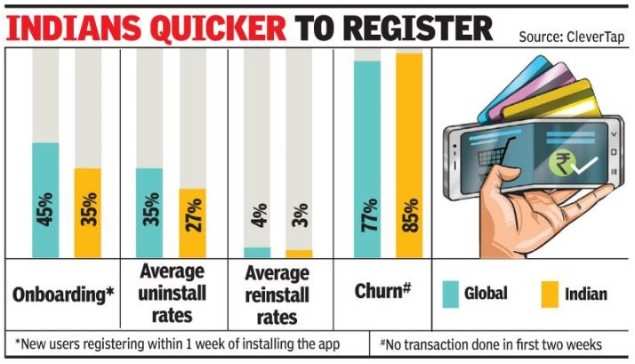

“Companies spend huge sums of money to advertise, market themselves, offer discounts and cashbacks to get users on board. But after getting them on board, if usage is low, then it is an indicator that the apps aren’t doing enough to keep customers engaged. And the churn rate (defined by no transaction done in the first two weeks) for India at 85% is worrisome — and is higher than the global average of 77%,” said Almitra Karnik, head of marketing and global growth at CleverTap, which conducted the study.

CleverTap is a Californiabased behavioural analytics company that measured usage patterns in 700 million mobile devices globally for the study. Karnik said if the app is not used in the first two weeks, it will invariably remain dormant thereafter, until a day when the user decides to uninstall it.

About 27% of Indian users uninstall e-wallets within two weeks of usage. But Indian apps seem to have better retention power than their global peers, who have a higher uninstallation rate of 35%. The average rate of reinstallation in India was a low 3%, showing that when a customer has a bad experience with a financial services app, s/he is unlikely to ever return to it.

Paytm did not respond to a request for a comment. Payment services firm PhonePe’s CEO Sameer Nigam said its app retention numbers are much healthier than what the CleverTap study shows. He said that was because a large percentage of its installs are organic (without providing incentives for the download) or referral-driven. “More than 75% of uninstalls happen when the installs are driven by low-quality digital marketing,” he said.

Fintech firm PayU’s CEO Jitendra Gupta also said 85% of downloads of its consumer-facing app LazyPay is organic. The user, he said, sees a clear proposition and is not driven by things like cashbacks. He admitted that the uninstall rate is 28-30%, but said this cannot be the only criterion to judge an app by. “On an average, every user is using LazyPay six times a month. We have 90% repeat users on a monthly basis. Besides, our uninstalls happen in cases where we don’t provide credit facility to the user, and those are obvious cases for uninstallation,” he said. LazyPay provides personal loans and pay-later options.

“Companies spend huge sums of money to advertise, market themselves, offer discounts and cashbacks to get users on board. But after getting them on board, if usage is low, then it is an indicator that the apps aren’t doing enough to keep customers engaged. And the churn rate (defined by no transaction done in the first two weeks) for India at 85% is worrisome — and is higher than the global average of 77%,” said Almitra Karnik, head of marketing and global growth at CleverTap, which conducted the study.

CleverTap is a Californiabased behavioural analytics company that measured usage patterns in 700 million mobile devices globally for the study. Karnik said if the app is not used in the first two weeks, it will invariably remain dormant thereafter, until a day when the user decides to uninstall it.

About 27% of Indian users uninstall e-wallets within two weeks of usage. But Indian apps seem to have better retention power than their global peers, who have a higher uninstallation rate of 35%. The average rate of reinstallation in India was a low 3%, showing that when a customer has a bad experience with a financial services app, s/he is unlikely to ever return to it.

Paytm did not respond to a request for a comment. Payment services firm PhonePe’s CEO Sameer Nigam said its app retention numbers are much healthier than what the CleverTap study shows. He said that was because a large percentage of its installs are organic (without providing incentives for the download) or referral-driven. “More than 75% of uninstalls happen when the installs are driven by low-quality digital marketing,” he said.

Fintech firm PayU’s CEO Jitendra Gupta also said 85% of downloads of its consumer-facing app LazyPay is organic. The user, he said, sees a clear proposition and is not driven by things like cashbacks. He admitted that the uninstall rate is 28-30%, but said this cannot be the only criterion to judge an app by. “On an average, every user is using LazyPay six times a month. We have 90% repeat users on a monthly basis. Besides, our uninstalls happen in cases where we don’t provide credit facility to the user, and those are obvious cases for uninstallation,” he said. LazyPay provides personal loans and pay-later options.

No comments:

Post a Comment