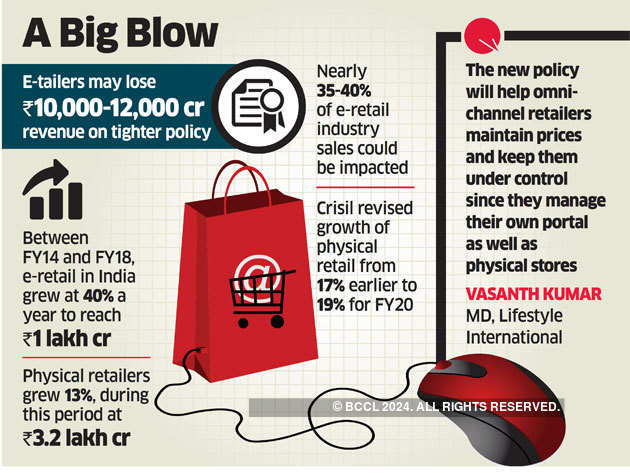

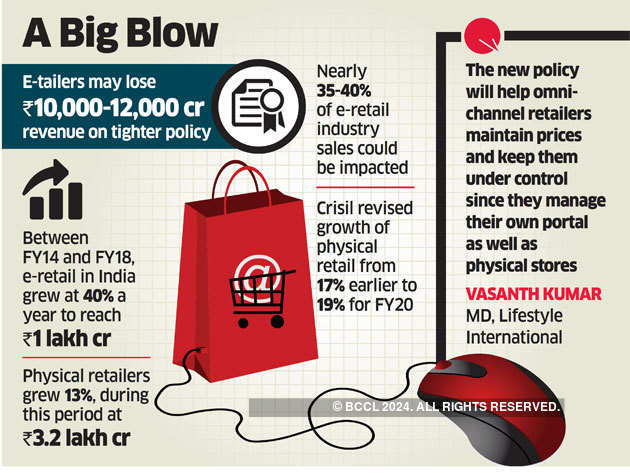

Online retailers could take a Rs 35,000-40,000-crore hit on their FY20 revenues to comply with the revised foreign investment policy, according to Crisil. Brick-and-mortar stores, as a result, may see a 150-200-bps spike in sales with an additional Rs  12,000-crore-plus mop-up.

12,000-crore-plus mop-up.

“The fact that there will be a level playing field, which will create a balance in the market, is good for the growth of the retail business in India,” said Rakesh Biyani, joint MD at Future Retail. “I think the additional (Rs 10,000-12,000 crore) revenue is a fair assumption in a country where retail consumption is growing at 10%.”

A recent clarification from the Department of Industrial Policy & Promotion (DIPP) on the foreign direct investment (FDI) policy for eretailers restricts marketplaces, operators and their group companies from holding equity in sellers on their platforms, caps the percentage procurement for sellers from emarketplaces, and puts curbs on exclusive partnership with brands or providing favourable services to a few vendors.

The revised policy, to be effective from February, aims squarely at protecting the home-grown retailers, which have seen consumers drifting to the deep discounts online.

“Discounts should be moderate and that will help everyone,” said J Suresh, CEO at Arvind Brands & Lifestyle, which runs stores of nearly two dozen brands, including Gap, US Polo, Sephora and Children’s Place as a licensee or through JVs. “The brick-and-mortar mobile stores are going to benefit the maximum and the next beneficiary will be fashion.”

Between fiscal 2014 and 2018, e-retail in India grew 40% annually to reach Rs 1 lakh crore, far outstripping physical retailers’ 13% growth to Rs 3.2 lakh crore on a relatively higher base.

“Nearly 35-40% of e-retail industry sales, amounting to Rs 35,000-40,000 crore, could be impacted due to the tightened policy,” said Anuj Sethi, senior director, Crisil Ratings. It said that if offline retailers lap up even a fourth of the impacted sales of e-retailers, it would lead to an additional 150-200-basis-point revenue growth. The rating agency has revised revenue growth of physical retailers to 19% for FY20 from 17% earlier.

“The new policy will help omnichannel retailers maintain prices and keep them under control since they manage their own portal as well as physical stores,” department store chain Lifestyle International MD Vasanth Kumar said.

Crisil expects the impact on e-retailers to be largely on the electronics and apparel segments, which account for a bulk of their revenue. Also, for most retailers, including Amazon and Flipkart, their own labels account for over 10% of sales, and has price advantage.

These top two e-retailers, accounting for about 70% of the e-retail industry revenue, generate about half of their sales through group companies. Following the restriction on equity ownership in sellers, e-retailers will need to make changes in their supply chain and may tweak business models in several ways, including adoption of franchisee model, leading to increase in the cost of compliance as they strive to adhere to revised guidelines in less than 40 days.

12,000-crore-plus mop-up.

12,000-crore-plus mop-up.“The fact that there will be a level playing field, which will create a balance in the market, is good for the growth of the retail business in India,” said Rakesh Biyani, joint MD at Future Retail. “I think the additional (Rs 10,000-12,000 crore) revenue is a fair assumption in a country where retail consumption is growing at 10%.”

A recent clarification from the Department of Industrial Policy & Promotion (DIPP) on the foreign direct investment (FDI) policy for eretailers restricts marketplaces, operators and their group companies from holding equity in sellers on their platforms, caps the percentage procurement for sellers from emarketplaces, and puts curbs on exclusive partnership with brands or providing favourable services to a few vendors.

The revised policy, to be effective from February, aims squarely at protecting the home-grown retailers, which have seen consumers drifting to the deep discounts online.

“Discounts should be moderate and that will help everyone,” said J Suresh, CEO at Arvind Brands & Lifestyle, which runs stores of nearly two dozen brands, including Gap, US Polo, Sephora and Children’s Place as a licensee or through JVs. “The brick-and-mortar mobile stores are going to benefit the maximum and the next beneficiary will be fashion.”

Between fiscal 2014 and 2018, e-retail in India grew 40% annually to reach Rs 1 lakh crore, far outstripping physical retailers’ 13% growth to Rs 3.2 lakh crore on a relatively higher base.

“Nearly 35-40% of e-retail industry sales, amounting to Rs 35,000-40,000 crore, could be impacted due to the tightened policy,” said Anuj Sethi, senior director, Crisil Ratings. It said that if offline retailers lap up even a fourth of the impacted sales of e-retailers, it would lead to an additional 150-200-basis-point revenue growth. The rating agency has revised revenue growth of physical retailers to 19% for FY20 from 17% earlier.

“The new policy will help omnichannel retailers maintain prices and keep them under control since they manage their own portal as well as physical stores,” department store chain Lifestyle International MD Vasanth Kumar said.

Crisil expects the impact on e-retailers to be largely on the electronics and apparel segments, which account for a bulk of their revenue. Also, for most retailers, including Amazon and Flipkart, their own labels account for over 10% of sales, and has price advantage.

These top two e-retailers, accounting for about 70% of the e-retail industry revenue, generate about half of their sales through group companies. Following the restriction on equity ownership in sellers, e-retailers will need to make changes in their supply chain and may tweak business models in several ways, including adoption of franchisee model, leading to increase in the cost of compliance as they strive to adhere to revised guidelines in less than 40 days.

No comments:

Post a Comment