MUMBAI | NEW DELHI: Amazon’s food-only retail business will stop selling on Amazon.in if the government’s latest foreign direct investment (FDI) guidelines remain unchanged by next month.

MUMBAI | NEW DELHI: Amazon’s food-only retail business will stop selling on Amazon.in if the government’s latest foreign direct investment (FDI) guidelines remain unchanged by next month. This would be a blow for the initiative as Amazon was the only foreign retailer to have committed investment — to the tune of $500 million — in the food retail segment after it opened up in mid-2016. In addition, Amazon’s planned acquisition of a stake in Future Retail may be delayed, people familiar with the matter told ET.

This development follows the latest notification on ecommerce FDI, which prohibits marketplaces from selling affiliates’ products. It goes into effect on February 1.

“Amazon Retail India Pvt Ltd (ARIPL), which is a seller of foodstuff on Amazon.in, will stop selling post-February 1 in a bid to comply with the new marketplace regulations,” said one of the persons with direct knowledge of the development.

'STILL EVALUATING NEW GUIDELINES'

An Amazon spokesperson said the company was still evaluating the new norms. “We remain committed to invest in India in a way that can work with the government’s vision towards the farmer and agricultural community but at present, we are still evaluating the Press Note 2 guidelines,” said the company.

The government tightened norms for FDI-funded ecommerce companies including Flipkart and Amazon in December and said such entities cannot exercise ownership or control over inventory. They must provide services such as warehousing, logistics and advertising to all sellers in a fair manner. It also disallowed ecommerce companies from entering into pacts for the exclusive sale of products and from holding equity stakes in their sellers.

These new norms have also cast their shadow over Amazon’s proposed stake acquisition in Kishore Biyani’s Future Retail. The US online retailer was in talks to pick 9.5% stake in Future Retail and the deal was supposed to be announced last year.

The person quoted earlier said that as the new norms prevent a foreign marketplace company from holding any stake in a seller on its platform, it is unlikely that the transaction can now go ahead. The Future group is a seller on the Amazon platform and after the new guidelines Amazon won’t be able to ride on Future Retail’s brand portfolio or store network.

But another person said the deal is ‘on track’ and is in the process of being restructured.

“We do not comment on speculation about what Amazon may or may not do in time to come,” said the Amazon spokesperson in response to a query on the Future stake purchase.

Amazon was in discussions to acquire a stake in India’s largest listed retailer through the foreign portfolio investor (FPI) route, similar to its earlier deal two years ago when it acquired a 5% stake in Shoppers Stop for about Rs 180 crore. An individual FPI can hold up to 10% in an Indian entity though multiple FPIs can hold up to 49% stake.

Amazon had also acquired a stake in More supermarkets from Aditya Birla Retail through Witzig Advisory Services along with co-investor Samara Capital a quarter ago. Just last week, the Competition Commission of India sought details from Samara Capital on the role of Amazon and how the proposed deal is in line with the government’s revised FDI ecommerce policy.

ROADBLOCK FOR FOOD RETAIL

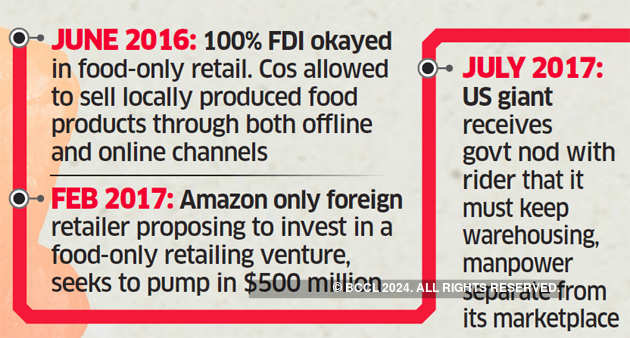

In 2016, India had for the first time permitted 100% overseas subsidiaries to retail locally produced food items through both offline and online channels to help farmers and create jobs. The initiative had received lukewarm response from foreign investors until Amazon applied through the route.

In 2017, the government approved Amazon’s proposal to invest $500 million to sell locally produced food items through both brick and mortar stores and e-commerce. Amazon has not yet started physical stores for food only retailing and ARIPL is selling primarily on Amazon.in.

Legal experts are said to have told Amazon that the latest changes will mean ARIPL can’t sell on the Amazon marketplace starting February 1. FDI-funded platforms can’t sell products from any entities with which they have equity relationships when the changes go into effect.

No comments:

Post a Comment