BENGALURU: For its ambitious target of reaching 40 billion digital transactions in the financial year ending in March 2020, ministry of electronics and information technology (MeitY) has asked about 7.7 billion of such transactions to come from SBI. Additionally, SoftBank and Alibaba-backed Paytm has been given a target of 5 billion transactions through its payments bank and popular mobile wallet.

BENGALURU: For its ambitious target of reaching 40 billion digital transactions in the financial year ending in March 2020, ministry of electronics and information technology (MeitY) has asked about 7.7 billion of such transactions to come from SBI. Additionally, SoftBank and Alibaba-backed Paytm has been given a target of 5 billion transactions through its payments bank and popular mobile wallet. Private sector lenders HDFC Bank and ICICI Bank are expected to chip in with about 2.5 billion and 2.8 billion transactions respectively, according to four people aware of this mandate given to banks and payments platforms. For the financial year ended March 2019, the target was of about 30 billion digital transactions, of which 90-95% was met, these people said.

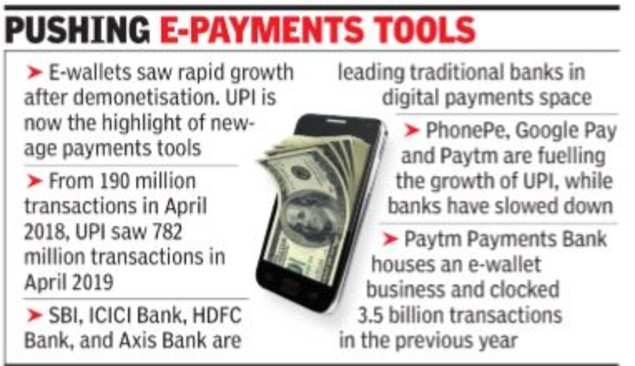

As the Modi-led government comes back to power with a bigger mandate than in 2014, it is looking to double down on growth in digital payments and its mass adoption. While banks will play a critical role for digital payments to soar further, mobile wallets and the Unified Payments Interface (UPI) are key instruments for the success of digital

“There are new options being considered to take UPI to the masses. If a player like WhatsApp gets the final nod for a full-scale rollout, it would change the way peer-to-peer payments are done,” a person aware of the goings-on said.

Among the leading institutions, Paytm is the only entity that has traditionally not been a bank but has one of the largest consumer bases. Other major players in the UPI space, which include Google Pay and Flipkart-owned PhonePe, work with banks to offer the service.

To push digital payments, regulatory bodies like the RBI, IRDAI and Sebi are set to come up with regulatory sandboxes to work and test new technologies in the market. While the targets were allocated before the elections, once the swearing-in of new ministers takes place, things will further accelerate, one of the persons aware of the government’s thinking added.

Emails sent to the banks, MeitY and Paytm did not elicit any response on the matter. Sources said the estimates are ambitious but achievable as UPI adoption is stronger now and it has emerged as a leading choice of digital payments among top-tier internet users in the metro cities. “Focus on digital payments will only accelerate going forward. It also brings transparency and makes the economy formalised,” said Ankur Pahwa, partner and national leader (e-commerce and consumer internet), EY India. He added UPI will continue to lead the digital payments stack in India.

The digital payments estimate covers card-based payments, immediate payment service (IMPS), digital wallets, UPI, national automated clearing house (NACH) and Aadhaar-enabled payment system (AePS). UPI, in the last one year, has seen mercurial growth and it continues to grow even on a higher base now. In March, it saw 800 million transactions through its network even though it saw a marginal dip in volumes at almost 782 million transactions in April.

No comments:

Post a Comment