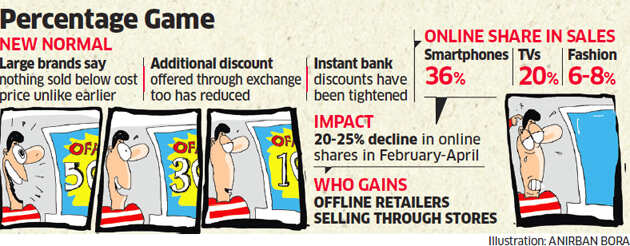

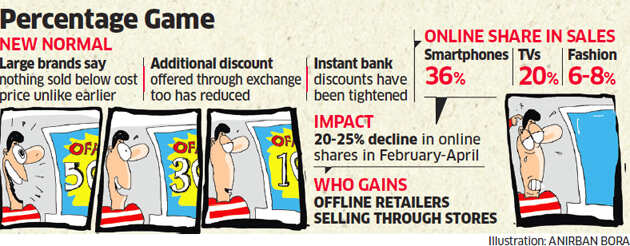

Deep discounts offered on India’s two largest ecommerce marketplaces, Walmart-owned Flipkart and Amazon, have vanished for over three months now, said executives from leading consumer companies.

Nothing is sold below cost price anymore, they said, though discounts may be more on private label products owned by the marketplaces, which are treading cautiously after the revised foreign investment policy for ecommerce came into effect in February.

The two marketplaces have decided to take it slow, at least until the next government takes charge, hoping to fend off the offline trade lobby, which is a massive vote bank and has been lobbying with the government and political parties against deep discounts online, said four executives of leading companies.

Some executives said it’s a sign that the online marketplaces are maturing and targeting profitability.

The executives from consumer electronics, mobile phone, fashion and lifestyle companies said the quantum of online discounts has been scaled down by 10-30% between February and mid-May as compared to the same period last year.

ECOMM COS EYEING PROFITABILITY

The categories account for about 80% of the total ecommerce business in India. The level of discounts has come down even though both Amazon and Flipkart, flush with funds, periodically run promotional sales, they said.

“Deep discounts have stopped completely,” said Puma India MD Abhishek Ganguly. He said the discounts offered in the marketplaces were down by 11-14% in the January to March period.

There’s been an increase in products sold at full price or at a reduced markdown, said J Suresh, CEO of Arvind Lifestyle Brands, which has in its portfolio brands including Arrow, Tommy Hilfiger and Aeropostale. However, he said he would be cautious about whether the trend of subdued discounts would continue in upcoming sales.

Apart from the revised foreign investment norms, ecommerce companies may be increasingly looking at profitability of their operations, the executives said.

Walmart is keen to drive profitability at Flipkart. Amazon has reduced its stake in its two main sellers, Cloudtail and Appario, from 49% to 24% to comply with the revised norms. With Indian promoters now in the driver’s seat, they may want profitable growth, the executives said.

An Amazon India spokesperson said prices for products on its online platform are set by sellers.

“We work hard and continually innovate to offer services such as Fulfilment by Amazon, Easy Ship and Seller Flex to sellers on our marketplace that enables them to significantly lower their cost of selling and reducing defects as they sell to a nationwide customer base,” the spokesperson said.

Emails sent to Flipkart, Cloudtail and Appario remained unanswered till press time Wednesday.

The average selling price has improved this year due to lower discounting of 10-20%, said Avneet Singh Marwah, CEO of Super Plastronics, the maker of Thomson and Kodak TV sets in India.

ONLINE SALES SLOW DOWN

Price erosion for products sold online has narrowed even though sales growth has been easing since January, said Gunjan Srivastava, MD of BSH Household Appliances, which sells Bosch and Siemens appliances. The market has slowed but the quantum of discounting has come down, including on exchange offers, said Manmohan Ganesh, COO of BPL, which sells TVs and refrigerators online.

“The marketplaces have realised that just dropping prices will not push sales,” he said.

Apart from lower exchange values, the offer of instant bank discounts has been tightened in online marketplaces by raising the minimum eligible cart value. Amazon offered an additional 10% instant bank discount on total purchases of Rs 3,000 in a single bill during its sale last week, while for Flipkart’s ongoing sale, it is Rs 4,999. Last year, the minimum cart value for such offers was about Rs 2,500.

Puma’s Ganguly said despite the tightening discounts, the company’s sales increased by 16% on Flipkart and 21% on Amazon between January and March.

OFFLINE LOBBY HAPPY

The lower discounts being offered online now are in stark contrast to those of the past few years, including Diwali sales in 2018, when ecommerce companies cannibalised sales in brick-and-mortar stores.

Now, the offline lobby isn’t complaining. All India Mobile Retailers Association president Arvinder Khurana said online discounting on smartphones has come down, although it remains to be seen if this will end after the next government takes over or continue until Diwali.

An executive with a leading onlinefocussed mobile phone maker said discounts offered earlier were meant to catch eyeballs. “But now they want to target existing customers who too have matured,” he said.

Nothing is sold below cost price anymore, they said, though discounts may be more on private label products owned by the marketplaces, which are treading cautiously after the revised foreign investment policy for ecommerce came into effect in February.

The two marketplaces have decided to take it slow, at least until the next government takes charge, hoping to fend off the offline trade lobby, which is a massive vote bank and has been lobbying with the government and political parties against deep discounts online, said four executives of leading companies.

Some executives said it’s a sign that the online marketplaces are maturing and targeting profitability.

The executives from consumer electronics, mobile phone, fashion and lifestyle companies said the quantum of online discounts has been scaled down by 10-30% between February and mid-May as compared to the same period last year.

ECOMM COS EYEING PROFITABILITY

The categories account for about 80% of the total ecommerce business in India. The level of discounts has come down even though both Amazon and Flipkart, flush with funds, periodically run promotional sales, they said.

“Deep discounts have stopped completely,” said Puma India MD Abhishek Ganguly. He said the discounts offered in the marketplaces were down by 11-14% in the January to March period.

There’s been an increase in products sold at full price or at a reduced markdown, said J Suresh, CEO of Arvind Lifestyle Brands, which has in its portfolio brands including Arrow, Tommy Hilfiger and Aeropostale. However, he said he would be cautious about whether the trend of subdued discounts would continue in upcoming sales.

Apart from the revised foreign investment norms, ecommerce companies may be increasingly looking at profitability of their operations, the executives said.

Walmart is keen to drive profitability at Flipkart. Amazon has reduced its stake in its two main sellers, Cloudtail and Appario, from 49% to 24% to comply with the revised norms. With Indian promoters now in the driver’s seat, they may want profitable growth, the executives said.

An Amazon India spokesperson said prices for products on its online platform are set by sellers.

“We work hard and continually innovate to offer services such as Fulfilment by Amazon, Easy Ship and Seller Flex to sellers on our marketplace that enables them to significantly lower their cost of selling and reducing defects as they sell to a nationwide customer base,” the spokesperson said.

Emails sent to Flipkart, Cloudtail and Appario remained unanswered till press time Wednesday.

The average selling price has improved this year due to lower discounting of 10-20%, said Avneet Singh Marwah, CEO of Super Plastronics, the maker of Thomson and Kodak TV sets in India.

ONLINE SALES SLOW DOWN

Price erosion for products sold online has narrowed even though sales growth has been easing since January, said Gunjan Srivastava, MD of BSH Household Appliances, which sells Bosch and Siemens appliances. The market has slowed but the quantum of discounting has come down, including on exchange offers, said Manmohan Ganesh, COO of BPL, which sells TVs and refrigerators online.

“The marketplaces have realised that just dropping prices will not push sales,” he said.

Apart from lower exchange values, the offer of instant bank discounts has been tightened in online marketplaces by raising the minimum eligible cart value. Amazon offered an additional 10% instant bank discount on total purchases of Rs 3,000 in a single bill during its sale last week, while for Flipkart’s ongoing sale, it is Rs 4,999. Last year, the minimum cart value for such offers was about Rs 2,500.

Puma’s Ganguly said despite the tightening discounts, the company’s sales increased by 16% on Flipkart and 21% on Amazon between January and March.

OFFLINE LOBBY HAPPY

The lower discounts being offered online now are in stark contrast to those of the past few years, including Diwali sales in 2018, when ecommerce companies cannibalised sales in brick-and-mortar stores.

Now, the offline lobby isn’t complaining. All India Mobile Retailers Association president Arvinder Khurana said online discounting on smartphones has come down, although it remains to be seen if this will end after the next government takes over or continue until Diwali.

An executive with a leading onlinefocussed mobile phone maker said discounts offered earlier were meant to catch eyeballs. “But now they want to target existing customers who too have matured,” he said.

No comments:

Post a Comment