Bengaluru: The proposal to deduct tax at source from online merchants, announced in the Budget, could precipitate a working capital crunch for some of the largest sellers on India’s top two ecommerce marketplaces Flipkart and Amazon.

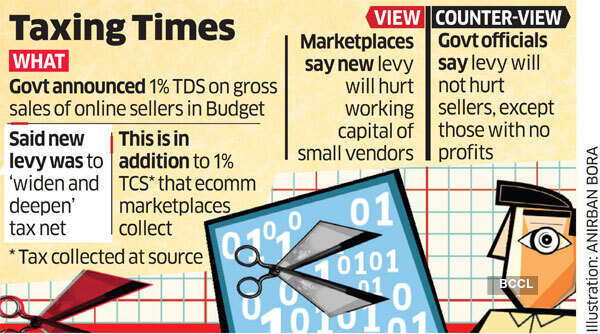

Bengaluru: The proposal to deduct tax at source from online merchants, announced in the Budget, could precipitate a working capital crunch for some of the largest sellers on India’s top two ecommerce marketplaces Flipkart and Amazon.Cloudtail and Appario that sell on Amazon, as well as RetailNet India, Tech-Connect Retail and Omni Retail that sell through Flipkart, record significant revenues but earn low profit. The proposal to levy 1% tax deducted at source would mean these vendors will have to fork out excessive amounts as tax deducted at source (TDS), an analysis by ET shows.

For instance, Cloudtail and Appario reported revenues of Rs 8,945 crore and Rs 6,049 crore, respectively, in financial year 2019, but their profits were just Rs 29.4 crore and Rs 12.2 crore.

Cloudtail declined to comment for this story. Appario could not be reached for comment. Both Flipkart and Amazon have said 1% TDS on gross sales would hurt small sellers the most.

Marketplaces Write to CBDT

“We have highlighted these concerns as well as the increased cost of compliance for MSMEs/ sellers and the ecommerce industry to the government,” a Flipkart spokesperson said in an email.

An Amazon spokesperson too told ET that sellers had voiced concerns over the 1% TDS for which it has sought clarification from the government.

These ecommerce marketplaces including Snapdeal, Amazon and Flipkart have approached the government through industry body Ficci seeking a reversal of the budget proposal. In a representation to the Central Board of Direct Taxes (CBDT), the industry lobby claimed the 1% levy will hurt the working capital of small sellers and increase their compliance burden. ET had reviewed a copy of the letter.

Ficci has said the TDS will “negatively impact working capital of the vendors and could lead to reduced trading activity, thereby impacting economic growth”.

However, senior government officials ET spoke to said the TDS would not hurt small sellers, but only those that were not making any money.

“We’ve only levied 1% TDS. Even if someone is selling Rs 100 worth of goods and has a margin of just Rs 3, they already have tax liability. Moreover, they’re already paying advance tax,” a senior government official said on condition of anonymity. “If you’re not earning anything, only then this might be a problem for you, and as you know, there are very few of those.”

Another senior tax official told ET that the CBDT’s intent in demanding the levy was to ensure that “all the turnover is being reported”. ET reported on February 23 that ecommerce marketplaces had asked for more time to implement the levy citing delays in updating their IT systems, although they had in-principle agreed to adhere to the new tax. A senior executive at a large ecommerce marketplace said the sector was being unfairly targeted compared to offline vendors.

“Ecommerce makes up just 3% of retail in our country, but we’re being targeted by the taxman while the 97% aren’t being touched. Are they coming after us just because we have data on all our sellers?”

No comments:

Post a Comment