BENGALURU: As mobile wallets grapple with regulatory constraints, startupsworking around the buy-now-pay-later model sense fresh opportunity by leveraging the ease of transaction they offer.

BENGALURU: As mobile wallets grapple with regulatory constraints, startupsworking around the buy-now-pay-later model sense fresh opportunity by leveraging the ease of transaction they offer.Industry insiders said mobile wallets, which were originally positioned as a single-click checkout process for online commerce, can slowly give way to a tab systemwhere consumers can make purchases in one go and pay in bulk later. They might not be as mass market as wallets, but from a checkout convenience factor, they could be better than wallets.

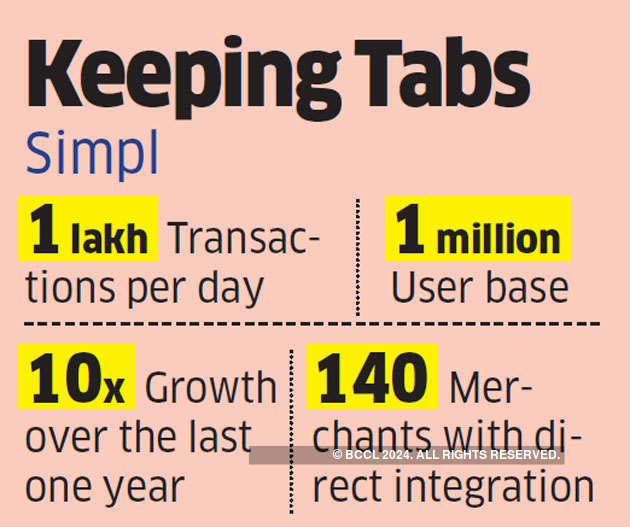

Success rate for transactions on this mode are as high as 99%, which is one of the major selling points for ecommerce companies, according to the insiders. Nityanand Sharma, who cofounded Simpl, said that his product leverages the age-old ‘khata’ system, where the local grocer or the merchant maintained a notebook and the consumer would pay in bulk at the end of the month.

“The practice of keeping a ‘tab’ is an old tradition in India and permeates from large cities to small towns and villages. We want to build Simpl as a massmarket product in that fashion based on people’s trust,” he said. Sharma said that mobile wallets could hardly offer a single click checkout option because in more than 80% cases a consumer would need money to be added to the wallet during the purchase. A product like Simpl, on the other hand, offers the true single-click checkout option.

Jitendra Gupta, who heads LazyPay, said buy-now-pay-later is a typical credit product for consumers who are otherwise not eligible for a credit card. This helps ecommerce companies serve those who might not have a credit card but the purchasing capacity. “A top food delivery startup told us that loyalty of customers using LazyPay is much higher and their stickiness is also growing,” Gupta said.

“Merchants look at entities like us from a convenience factor, but a consumer looks at it both as a convenient payment option as well as a credit card replacement.” Gupta said that 70% of the repayments on LazyPay are happening through debit cards, net banking or Unified Payments Interface (UPI), which indicates that the users do not have credit cards.

LazyPay is disbursing around 1.6 million loans per month. Besides a pay-later feature, it has a personal loans product, too. “What wallets targeted initially, pay-later products can successfully achieve. It can convert cashon-delivery purchases into digital payments,” said Aurko Bhattacharya, cofounder of ePayLater, a Mumbai-based startup working in the same space. “Consumers here get the product delivered and pay later when the bill is due.”

Though these instruments are poised to compete with the mobile wallets from a convenience point of view, Gupta feels they can never be a mass-market product like mobile wallets. “It is like post-paid accounts for telecom companies. It will be only for a select group of people and hence users of this product will continue to be a small part of the entire wallet user base,” he said.

No comments:

Post a Comment