BENGALURU | NEW DELHI: Lee Fixel, the secretive American investor, best known in India as the man who powered the rise of ecommerce giant Flipkart, is poised to return to his old hunting grounds in a new avatar, said several members of the country’s startup fraternity who are directly aware of his plans.

BENGALURU | NEW DELHI: Lee Fixel, the secretive American investor, best known in India as the man who powered the rise of ecommerce giant Flipkart, is poised to return to his old hunting grounds in a new avatar, said several members of the country’s startup fraternity who are directly aware of his plans.On Thursday, Tiger Global, the New York-based investment firm where Fixel has worked for over 13 years, said the technology investor would leave the firm on June 30.

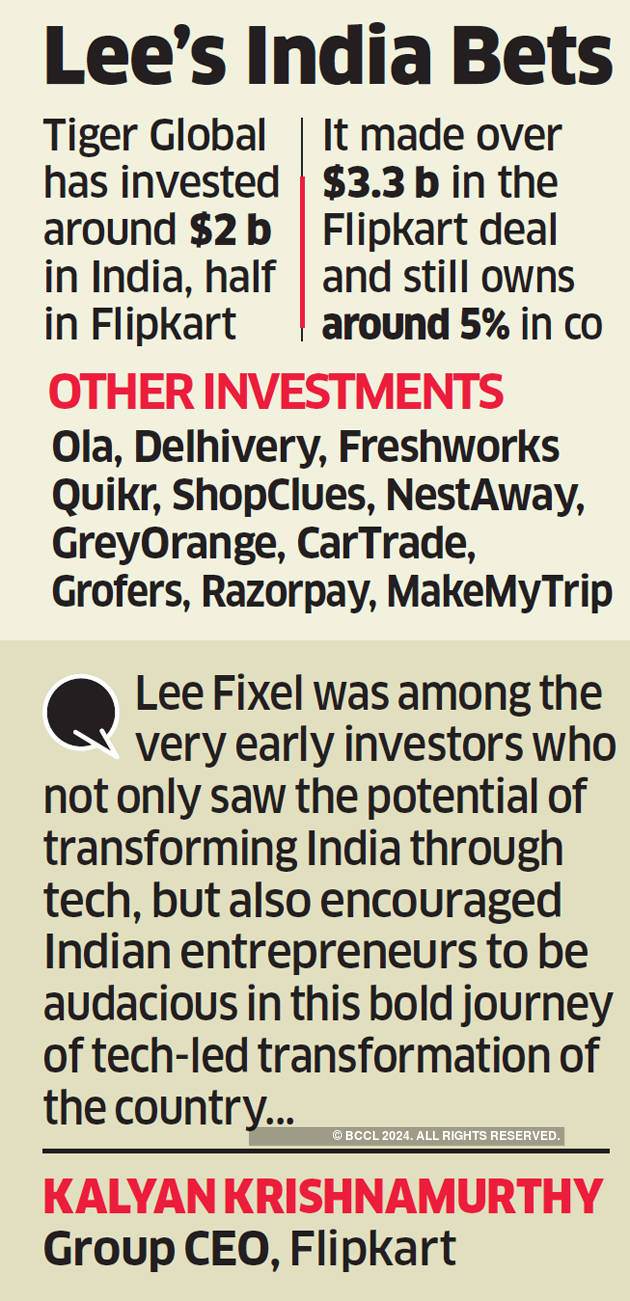

Fixel was responsible for scaling up the hedge fund’s private market portfolio which now constitutes half of the fund’s $26 billion assets under management. In a letter to its limited partners, or sponsors of the fund, the firm said: “Lee expects to actively invest his own capital and may start an investment firm in the future.”

“He is likely to make a comeback scouting for early and growth-stage technology investments in India, Bay Area and South East Asia via his own fund,” four people in the know of his plans told ET. “His understanding, network and reputation across these geographies are strong, and he will soon separately raise capital for his fund,” said one of the persons.

Fixel, who is estimated to be armed with a personal capital of $800 million to $1 billion, “began informing a select group of founders from Tiger Global’s Indian portfolio (of his impending exit from the firm) a week ago,” the sources said.

“He had earlier asked them to scout for bets in healthcare and fintech sectors,” the sources added.

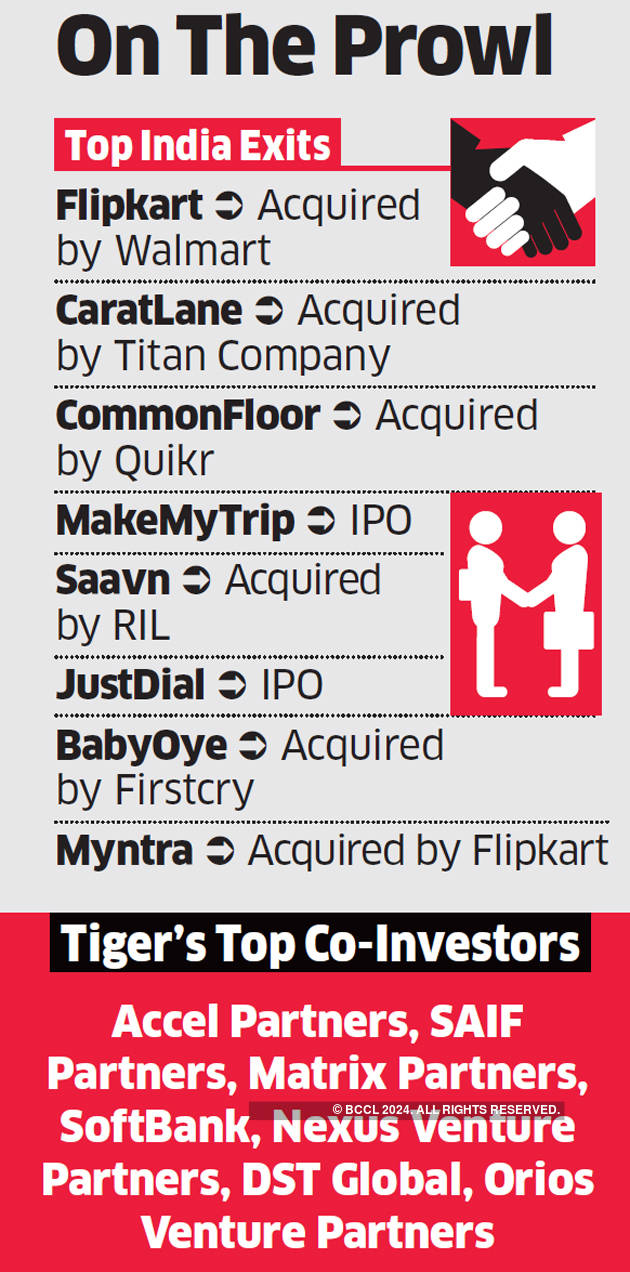

The 39-year-old is credited with backing some of the world’s most stellar startups like Spotify and Stripe, in addition to single-handedly crafting Tiger Global’s Indian portfolio, beginning with early investments in Just Dial, MakeMyTrip and later, Flipkart cofounded by Sachin Bansal and Binny Bansal.

“I would say he is the pioneer who single handedly put the Indian startup scene on the global map,” said Binny Bansal.

“When Lee started investing in India not many global VCs looked at India favourably and even if some did, the consumer internet space was certainly not top of mind. Lee helped change that, with his long-term investments in Flipkart, Myntra, Ola, and MakeMyTrip among others,” he said.

Famously qualified as the ‘Maharaja’ (King) of Indian ecommerce, Fixel was the most important investor in Flipkart, working through close aide Kalyan Krishnamurthy, the present group CEO at the etailing major.

The reticent fund manager went on to orchestrate Flipkart’s sale to US retail giant Walmart for $16 billion in May last year.

“(Fixel) will continue to be on the board of Flipkart Group. We have immensely benefited from his vision, insights and global credibility for several years and we look forward to his continued engagement,” said Krishnamurthy.

Fixel’s bullishness on India was fuelled by the exponential growth of Chinese ecommerce and Tiger Global’s backing of JD.com in 2009, an investment which is considered the most successful for Tiger after the etailer went for a $25-billion IPO in 2014.

Along with his then colleague Feroze Dewan, Fixel started Tiger’s operations in India, possibly looking for a beachhead in the “next China”. This led to Fixel’s wager on Flipkart. In a few years, he had emerged as one of the most soughtafter tech investors locally, credited for the funding boom of 2014-15, a move for which he also drew criticism for driving up valuations of young startups.

Fixel hit a pause button as things also started to look down for Flipkart. By 2016, he had pumped more than $1 billion in Flipkart with no exit in sight, which also meant that India started taking a backseat for the fund. From striking around 40 new investments in India in 2015, Tiger Global came down to laying zero bets in 2016.

After almost three years, Tiger Global renewed its focus on the country with its mega $3.75 billion Private Investment Partners XI fund, with India as one of the focus areas. This came on the back of Flipkart’s acquisition by Walmart.

Indian entrepreneurs who have worked with him speak highly of his venture investing skills. “Lee works very differently. He never demands that we have board meetings every quarter to update him. If he needed to be updated, a call or even WhatsApp messages often sufficed,” said Harshil Mathur, chief executive of RazorPay.

Startup investors for their part credit him with having “caused a huge mindshift change in India”.

“He has been a VC in the true sense of the term, having always been willing to place adventurous bets. Before him, everyone was taking very conservative bets,” said Rehan Yar Khan, partner at Orios Venture Partners.

Fixel will continue to assist in the management and serve on boards of certain existing portfolio companies but will not be an active part of Tiger Global’s investment team beyond PIP XI.

Scott Shleifer and Chase Coleman will continue as co-portfolio managers of Tiger’s private equity business, and Shleifer will become the head of private equity.

“They’ve (Tiger) been slow anyhow over the last few years focusing more on follow-ons... If Fixel builds a new avatar, he will likely come back,” said Karthik Reddy, partner at Blume Ventures.

More recently, on the philanthropy front, the Lauren and Lee Fixel Family Foundation gifted $20 million to the University of Florida and UF Health that will be used to establish the Norman Fixel Institute for Neurological Diseases at UF Health, an institute focused on advancing research, technological innovation and clinical care for Parkinson’s disease and other neurodegenerative diseases, including Alzheimer’s, Lewy body, ALS, dystonia and concussions.

No comments:

Post a Comment