We are often taught tricks and tips to identify scams, frauds and hoaxes. Be it banks or MNCs, they all actively work towards informing their clients, and general public that ‘do not fall prey to scammers’. Indian Online Seller too has published several articles on dealing with fraudulent buyers, how to handle such situations and protecting yourself as a seller.

This tells us that no reputed business houses would want to be associated with or encourage any fraudulent schemes and activities. However, many sellers inform IOS that Snapdeal is not only encouraging fraudulent buyers on its platform, but is also partaking in it.

Most of these scams happen between a seller handing over his/her product to Snapdeal and getting the product back in a miserable condition as ‘returned goods’. This is where a perfectly ‘healthy’ item is returned in a ‘dead’ condition.

Tired of the money-guzzling scams, say Snapdeal sellers

According to online sellers, Snapdeal has become a breeding ground for fraud buyers. That’s why many have left or are considering leaving the platform.

IOS spoke to online seller Mayank Goyal, who listed down some of the major issues related to fraudulent buyers and practices that vendors are facing on Snapdeal. Here it is:

RTO is charged by Snapdeal: If any buyer orders and if it undeliverable due to buyer rejects, pincode issue, fake address, incomplete address, they charge very high shipping fees

Tax percentage changed of the product: When the seller is liable to pay tax to the government then Snapdeal interferes in changing tax percentage. My product is in 5% category and they are charging in 14.5% category. Why seller should pay extra 9.5%?

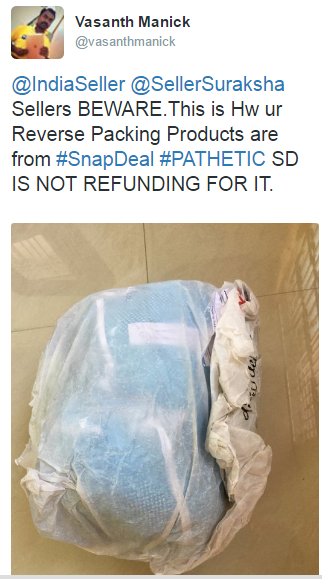

Packaging material: Now new funda has been introduced by marketplaces like Snapdeal. They are forcing sellers to use their package material so that they can charge high prices as fake orders, incomplete address, and fake complaints issues are increasing. And sellers cannot reuse the packaging material again. Therefore seller has to invest more in these marketplaces packaging material

Old packaging material to new packaging material: When Snapdeal changed their logo from old to new, the packaging material also changed. Why they are not replacing old with new packaging material? Because they are charging high price for the same.

Warehouse fraudulent activities: Snapdeal and marketplaces are doing fraudulent activities when the products reach its warehouse. They charge high storage fees, packing fee and removal fees. They charge irrelevant penalties too whether seller is at fault or not. They manipulate with the accounts too and debit the amount in sellers’ accounts.

Let the fraud countdown begin

Online Seller Harish shares with IOS why and how it is no longer feasible to be associated with Snapdeal.

Fraud Number 1 – Against the return policy

Harish received an order on 9th October, 2014, which was dispatched on 14th October, 2014. After 3 days of transit, the order was successfully delivered to the customer by Snapdeal logistic partner. The customer didn’t raise any return request during the 7-day return policy.

“Snapdeal had neither accepted return from the buyer nor returned to the seller, but Snapdeal had debited the sum of Rs. 14,292.24 INR on 18th July 2016 i.e., after one year and nine months, saying that product is returned to seller which is completely false information. We did not receive any product on that date,” informs Harish.

“On 16th November, 2016, we requested for payment reversal and the dispute team from Snapdeal had allocated payment cycle. Later they haven’t credited the amount till date. Now when we are asking for the payment they are saying they cannot help because it is out of policy,” he adds.

Fraud Number 2 – The poor condition of returned goods

Harish puts bluntly,

“Snapdeal’s logistic partners are really poor in handling the LED Panel.”

Check the below images shared by him.

He adds further,

“As per the new policy, Snapdeal will not compensate seller more than 7000.00inr in this damaged condition. Even if the seller receives the product in 100 pieces, they will compensate only Rs. 7000 and they will ask for apology.”

Fraud Number 3 – Reimbursement Payment for damaged product

As per the Snapdeal’s policy, whenever sellers’ product gets damaged during transit, they promise to compensate the damage after validating all the evidences submitted by the seller.

Harish received a product in a damaged condition for which Snapdeal agreed to reimburse 95% of the amount in the November payment cycle. But even after repeated follow-ups, the etailer hasn’t paid him. From November to December and then to January, Snapdeal has only been pushing the dates, according to the seller.

“They have failed to credit in the promised payment cycle. Again and again we have requested 3 times to Snapdeal team to credit the amount and they are simply allocating payment cycles and they have not been crediting the amount. We have some case pending from 2014 and till now we have not got the payments. Whenever we ask they are allocating the new payment cycle every time,” says Harish.

Fraud Number 4 – Snapdeal manipulates the order cancelation policy to extort penalties

The seller received an order on 19th December, which he handed over to the courier partner on 20th December, 2017 (IOS reviewed the shipping invoice shared by the seller). But Snapdeal’s team marked that order as ‘Cancellation due OUT OF STOCK’ blaming the seller for not shipping the product. Later Snapdeal debited a sum of Rs. 7464.95 as stock out commission charges! The etailer can charge this penalty only when a seller fails to dispatch the order within 3 days, which was not the case here. Is this Snapdeal’s dirty trick to make some extra money at the seller’s expense?

Fraud Number 5- Feeding wrong information in the seller panel to refuse responsibility

A buyer cancelled an order when the product was in transit. So as the process works, the product has to be returned to the seller. But Snapdeal’s courier partner marked the product as ‘undelivered due to address not found.’ On the other hand, Snapdeal marked the product as ‘delivered’ in its return panel.

Harish shares,

“..The logistic partner was searching for my location in Maharashtra. Snapdeal logistic partner says that this product was undelivered due address not found at destination city but my warehouse is located in Hyderabad. Snapdeal has gone beyond the logistic partner and marked on their portal as delivered but I did not get this product. When I am requesting to share the courier proof of delivery they are not helping out.”

Fraud Number 6 – Fake delivery attempts to liquidate sellers’ stock

When it comes to returning stock to the seller, if any product is undelivered then Snapdeal’s team sends a shipment alert. If the seller doesn’t respond then Snapdeal has the right to liquidate the product and seller can’t raise a claim to get his/her product or reimbursement. This is where it gets murky. Because according to sellers, Snapdeal makes fake delivery attempts and then keeps the stock and payment. IOS had published a separate story on this issue.

Harish too received an email from Snapdeal that states his product couldn’t be returned because ‘seller’s door was locked’.

“First of all, our warehouse is open 15 hours a days from morning 8 am to 11pm, 365 days. We work on Sundays, we work on festivals, we work on national holidays… If you guys (Snapdeal) made delivery attempt why none of our CCTV cameras shows anything,” Harish asks.

He adds,

“People should learn from snapdeal how to fraud the sellers. By sending these types of fake mails Snapdeal has claimed lakhs worth of our good. Snapdeal is so powerful that by sending one junk mail it can liquidate our product without our permission.”

For each issue, Harish shared proofs and evidences with IOS. We’re sure he shared the same with Snapdeal. Then why the marketplace was unable to look into his complaints and reimburse? Why Snapdeal is consistently getting a bad reputation? Bad as in, really bad.

We get it – the online world is full of scamsters be its buyers, sellers, suppliers or marketplaces. Snapdeal has been a victim of that too. Remember the fake mother-son duo or the B. Tech student that cheated the etailer? But how hard it is to take action against the fake buyers or fine-tune the return policies, based on the sellers’ complaints? Why Snapdeal is encouraging such scams? What’s going on Kunal Bahl?