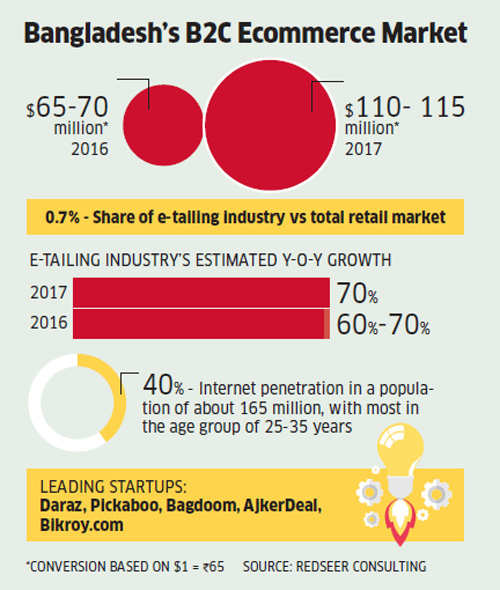

India’s online shopping industry is estimated to grow at 60 per cent to about $28.5 billion in terms of gross merchandise value (GMV) in 2018, according to a report.

The e-commerce industry is expected to return to high growth next year as large players such as Amazon, Flipkart and Paytm Mall begin to look beyond the 20 million customers who shop online on a monthly basis. Industry analyst RedSeer Consulting pegs the online shopping industry’s growth at 23 per cent to $17.8 billion in 2017.

“Once Flipkart raised money, they began spending aggressively and going after market share growth, prompting Amazon to follow. If you see growth this year, it was much higher in the second half compared to the first half. This strong growth in the second half will be the base for growth next year,” said Anil Kumar, chief executive officer, RedSeer Consulting.

While Flipkart’s growth had slowed due to unavailability of funds in 2016, a bigger detriment to the industry growth was delivered by Snapdeal. The erstwhile number three player saw negative GMV growth, which pulled down the overall industry growth.

Entering 2017, this slow growth hampered the first half of the year, until Flipkart raised $1.4 billion led by Tencent and $2.5 billion from Softbank. Now with sufficient funds, the company is once again turning on the heat and is looking to expand the base of online shoppers in the country.

RedSeer estimates that only 20 million people in the country shop online on a monthly basis. That figure swells to 90 million if we look at the number of people who shop online at least once a year. Beyond this, there’s a base of about 150 million people who are connected to the internet but have not shopped online yet.

“If you ask me, the large e-commerce players will go after this untapped segment of buyers. What will they have to do to bring them online? They’re going to have to improve trust, provide the right value and have the right kind of products listed on their platforms,” adds Kumar.

Going after first-time buyers would supersede the need to get existing customers to buy more frequently in 2018, the contrary of what happened in 2017. While this doesn’t mean that Amazon and Flipkart would stop trying to get repeat customers, the amount of attention and resources spent on it would be far lesser than reaching new customers.

The top online shoppers in India continue to be locked in metros, but if these companies want to reach new customers they will have to invest heavily in logistics, warehousing and coming up with new models. In 2015 and 2016 e-commerce firms solely relied on discounting to get more customers to shop from them, but after experiencing the ills of that model of growth, none are expected to return to that.E-com industry to grow at 60% in 2018