People who change their mind frequently are often termed as ‘temperamental’, ‘moody’, ‘unpredictable’ or ‘indecisive’. But what’s the term for ecommerce companies that change their policies frequently?

There’s no term for such firms as of now, but there sure are examples of firms that fit the description to the T. Flipkart, Amazon, Snapdeal, all fit the bill. And their fickle-mindedness is making payment reconciliations a tough nut to crack for sellers. Why won’t it be? It’s not easy to keep track of orders, returns, various fees & taxes, penalties & cancellations and accommodate last minute policy changes to calculate final payment due.

This is why tallying receivables remain a pain point for sellers.

The reasons why it is not really a walk in the park are:

- It’s a tedious, complicated task, more so in case of high sales volume

- Accommodating a big list of fees and charges like service tax, listing fee, fulfilment fee, logistic fee, which are subject to change any time

- The rate card varies from product category to product category, from marketplace to marketplace

- Lack of transparency on marketplace’s end with unfair/wrong penalties thrown in

- 2-3 months product returns window period after collecting from buyers

- Frequent policy changes

- General disregard for sellers’ payments across all levels of ecommerce companies

What are a seller’s options?

Indian Online Seller spoke to many sellers and asked them to share the method they follow to keep track of payments from marketplaces. We came across three methods:

- Sellers who don’t really track payments and have put their faith in marketplaces

- Sellers who maintain personal records manually (hand-written or through spreadsheets)

- Sellers who use ecommerce software or exclusive reconciliation software

Let’s explore each of these methods one by one.

Method 1 – No personal record, rely on marketplaces’ seller panel

This works for sellers who sell on 1-2 online marketplaces and sell limited products. Big ecommerce firms’ seller panel is often sufficient for few merchants as it provides all order details, all return details, weekly disbursement reports, and all pending dues. Marketplaces also send regular alerts through sms’ and emails.

“Initially I tracked payments from ebay and they have arrived without any issues. So I stopped tracking them!” says online seller Sanchit Goyal who sells on eBay and Amazon.

He adds,

“Sometimes I do some random checking though I know it’s not a best way to do things. On Amazon, I have not yet understand, their payment panel so I don’t track individual payment but I have heard from suppliers they are generally fine.”

According to Goyal, eBay’s payments are regular and easy to tally. And based on reviews of quite a few sellers, Amazon is considered to be far better than other marketplaces when it comes to disbursing correct payments.

Method 2 – Ecommerce and reconciliation softwares

With the growth of ecommerce industry in India, the need for ecommerce-specific products and services too have gone up. Merchants who sell on multiple ecommerce sites and receive high number of orders on a monthly basis choose to outsource their tasks including payment reconciliation to multi-channel order and inventory firms. Third-party ecommerce service providers help to keep track of payments from various marketplaces, paid/unpaid order stats, and unreasonable/extra deductions.

New tech start-ups that provide reconciliation solution exclusively have mushroomed as well. These softwares developed by sellers or independent developers are far from being flawless. But their attempt to help sellers to tackle basic issues related to calculating the final due amount from marketplaces is worth mentioning.

Then there is ERP & Accounting software Tally used by Chartered Accountants across the country. If you are willing to pay a quarterly rent of Rs. 1,800- Rs. 5,400, then you can get your hands on Tally. If you wish to buy it, then be prepared to shell out as high as 3, 60,000 (lowest- Rs. 18, 000).

Method 3 – Manual record keeping

If you don’t wish to or can’t afford to spend on paid software, then keeping a manual record is your safest bet. Most sellers use spreadsheets like Microsoft Excel to maintain payment reconciliation record.

Use formulas and functions like Pivot Table & VLOOKUP in the excel sheet to insert order details and track marketplace payments.

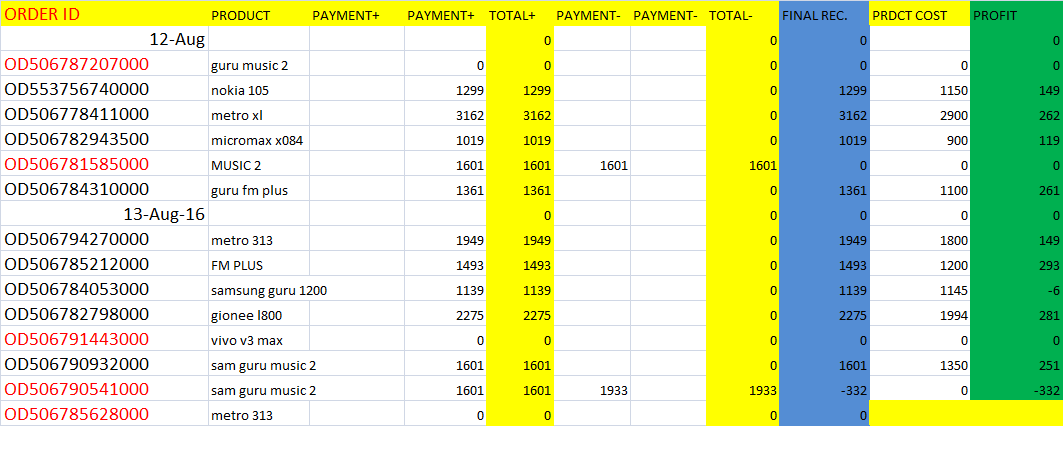

Seller Suresh Raj shared a sample dummy sheet to keep track of Flipkart payments with IOS.

But spreadsheets come with their own set of challenges, which can prove to be detrimental for your business. So make sure you leave no room for error and don’t fill the sheet in haste.

Keeping a personal record is also vital for sellers who sell on multiple marketplaces (particularly Flipkart, Snapdeal) and don’t use third-party order management services.

“For snapdeal I would suggest sellers to ALWAYS track payments. I sold on snap deal for 1 month 2 years back. Their payment cycle is bad and I found out they had conveniently skipped payment! Thankfully I checked and informed. Then they credited it. Never sold on snapdeal again!” cautions Goyal.

Is there a foolproof way?

No, there isn’t. Unless you are an accounting genius! Like one seller Chetan sums up (see image below)

Your aim should be to minimize the gap between the expected payment and actual payment received. The only way a seller can spot discrepancies immediately is if he/she religiously updates book of accounting or has a team in place (in-house or outsourced) to do the same on their behalf.

The ideal method lies somewhere between the three methods we listed above. What would suit your needs entirely depends on the number of marketplaces you sell on, the marketplace’s payment practices, number of products you sell, technical know-how and monetary budget.

Online sellers, which method do you use? Which one is the best according to you? Any tips or tricks you would like to share with the seller community? Please do leave your valuable comment.

No comments:

Post a Comment